Clarification regarding amendment in Special Economic Zone Rules No.11/2017

Dated 31st March, 2017 | Copy of | Notification No.11/2017 |

Representations have been received from field formations requesting clarification regarding amendments made in the Special Economic Zone Rules, 2006 by way of inserting a new Rule 47 (5) brought vide Department of Commerce (DoC) Notification No. GSR 772(E) dated 05.08.2016 wherein functional operations like Refund, Demand, Adjudication, Review and Appeal are to be made by jurisdictional Customs and Central Excise authorities in accordance with the relevant provisions contained in the Customs Act, 1962 & Central Excise Act, 1994 and the Finance Act, 1994.

2. Doubts have been raised regarding operationalization of these functions, appropriate authority and time limitation in respect of these functional operations, especially refund claims filed prior to the date of coming into effect of the said notification, i.e. 05.08.2016. It has been further asked to clarify as to who would be the appropriate authority, the Development Commissioner or the jurisdictional Customs Authority to raise demand of duty, if need arises, in respect of un-utilized capital goods/raw materials by a unit in case it exits/opts out of the SEZ.

3. Matter has been examined by the Board. The following clarification is accordingly issued in this regard.

3.1 With regard to whether these functional operations of refund, demand, adjudication etc. are to be handled prospectively or retrospectively, it is a settled law that unless, otherwise expressed specifically for retrospective application in the notification itself, all notifications are applicable prospectively only. Therefore, all new cases of refund, demand, adjudication, review and appeal are to be made by the concerned jurisdictional authorities of Customs, Central Excise and Service Tax under the provisions of the respective Acts. Also, with the coming into effect of the GST laws in the near future, apart from jurisdictional Customs Commissionerates, the jurisdictional GST Commissionerates will be responsible in respect of these functional operations with effect from the day GST is rolled out.

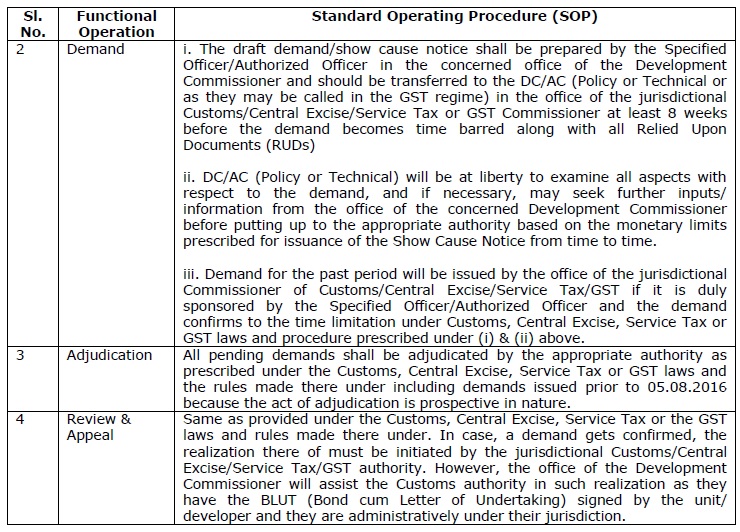

3.2 The standard operating procedures in respect of these functional operations would be as provided in the table below:

3.3 The question now arises as to how the old cases of refund pending as on the date of the coming into effect of this notification will be sanctioned/entertained by the Customs, Central Excise or Service Tax or Central GST authorities. The gap in the law was that there was no provision of giving refund in SEZ law. That provision has now been extended by way of amending SEZ Rules by inserting new Rule 47 (5) empowering officers of Customs to issue refund claims. Therefore, refund cases of past, which are otherwise in order, both on account of limitation and merit (even though filed in the office of the Development Commissioner) should be issued by Customs officers.

3.4 The issue of interest on delayed payment of refund may arise in some cases. However, in such cases, the date on which such refund claims are received by jurisdictional Customs, Central Excise or Service Tax or Central GST field formations would be relevant for our officers for the purpose of interest rather than the period for which it was lying with SEZ authorities, for which DOC will take necessary action as deem fit by them, if need arises.

3.5 The second issue relates to appropriate authority to demand duty in case a unit opts out of the SEZ scheme. As per Rule 74 of SEZ Rules, 2006, such exit shall be subjected to payment of applicable duties on the imported or indigenous capital goods, raw materials, components, consumables, spares and finished goods in stock. The proviso to the said Rule states that if the unit has not achieved positive net foreign exchange, the exit shall be subjected to penal action under the provisions of Foreign Trade (Development and Regulation) Act, 1992. Therefore, the Development Commissioner under the said Act may impose penalty on unit for not achieving positive net foreign exchange. However, in respect of duty benefits already taken on the unutilized capital goods/ raw materials for carrying out authorized operations, demand, adjudication and appeal thereof shall be made by the jurisdictional Customs, Central Excise & Service Tax authority under Rule 47(5) of the SEZ Rules, 2006 as being brought out by notification GSR 772(E) dated 05.08.2016 following procedure given in point no. (i) and (ii) against ‘Demand’ in the table above.

4. Difficulty, if any, in the implementation of this circular may be brought to the notice of the Board. Hindi version will follow.

Sd/-

(Saroj Kumar Behera)

Joint Director

to success.

to success.