Commodity export earnings forecast to dip due to low prices: World Bank

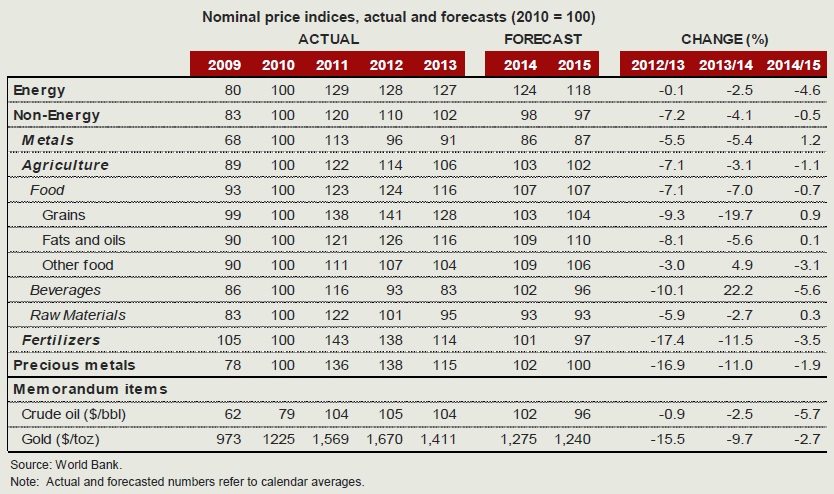

Bidhu Bhushan Palo | @TheDollarBiz Exporters of commodities are likely to face sluggish growth and low returns in the remaining months of 2014 and most of 2015 due to surplus stocks and uneven economic growth in Europe and emerging economies, the World Bank (WB) says in its October 2014 Commodity Markets Outlook. There are multiple factors behind the weakening of commodity prices in Q3 2014, including a growing concern over a slowdown in the Euro Area and emerging economies, a resurgent US dollar, surplus oil production and good prospects for most crops. Prices of a majority of “most primary commodities” (energy, metals, agriculture, precious metals and fertiliser), particularly oil and gold, are expected to remain weak in Q4 2014 and through much of 2015, says WB. Energy After signs of recovery earlier this year, growth in the Euro Area and emerging countries is expected to moderate in the coming months. This along with a growing supply and other geopolitical factors have led to a decline in energy prices in Q3 2014. The World Bank Energy Price Index declined by about 6% during Q3 2014 due to strong supply by both OPEC (including Iraq and Libya) and non-OPEC countries (including USA), but weak demand in emerging countries. Oil prices plunged to below $90 per barrel in early October 2014, and this is expected to will bring down the 2013 average to $102 per barrel, compared to $104 per barrel in 2013. The WB projects that oil prices are likely to remain at low levels through most of 2015 and rise above $102 per barrel only in 2021. Ayhan Kose, Director, World Bank’s Development Prospects Group, said, “A broad-based expansion in commodity supply is coinciding with weakness in global growth, especially in emerging economies, where most of the demand expansion has been taking place.” Metals Following a y-o-y drop of around 5.5% in 2013, metal prices this year are forecast to drop again by 5.5%. This is mainly due to subdued demand in China, which consumes almost half of global metals supplies of around 91 million tonnes. While zinc and nickel prices are expected to increase 13% and 16% respectively in 2014, sharp declines are forecast for iron ore (-26%) and copper (-5.6%). Lead and tin prices are unlikely to see any significant change this year, says WB. Precious metals Investors are turning away from gold as it has become less of a safe haven for them, leading to a price decline of the metal. This along with lower demand in China may cause precious metal prices to decline by around 2% in 2015. WB says that while its Industrial Metals Index may increase slightly in 2015, gold prices are expected to decline to $1,275 per troy ounce (toz) this year, down around 9.6% from 2013. Gold prices are forecast to further decline to $1,240/toz in 2015, which is down about 25.7% from its high of $1,670/toz in 2012.  Fertilisers Fertiliser prices are dependent on gas production and impact food prices. Fertiliser prices are forecast to decline sharply by around 12% in 2014, mainly due to higher production and low production costs. WB says that fertiliser prices have bounced back by around 4.9% in Q3 2014, but are still down around 6% from year-ago levels, and down about 60% from the high levels of 2008. Encouraged by low natural gas prices in USA, several companies are planning to build new fertiliser plants there, including a European fertiliser company which is expected to become the world’s largest producer of nitrogen fertiliser. The WB Fertiliser Price Index is expected to decline 11.5% in 2014 and an additional 3.5% next year, says WB. “Phosphate rock and potassium chloride will decline almost 25% each in 2015, urea will average 6.5% lower, but TSP and DAP will make some moderate gains,” it adds. Agriculture International food prices have been on a downward trend since 2012 and this is expected to continue through 2015. According to WB, maize prices are likely to plunge 27% y-o-y in 2014, while rice and wheat prices will drop by 16% and 9% respectively. However, coffee (Arabica) and cocoa prices could increase, particularly if the Ebola outbreak spreads in West Africa, says WB. India The World Bank has already downgraded growth prospects for LAC countries due to low commodity prices. However, low gold, fertiliser and oil prices could help countries such as India reduce spending on imports. John Baffes, Senior Economist, World Bank’s Development Prospects Group, said, “Lower commodity prices will help ease balance of payments pressures in food and energy importing countries. However, commodity exporting countries may feel the pinch because of lower export earnings.” India is a top agricultural products exporter, but its economy is heavily reliant on gold and oil imports. Currently, India’s agriculture exports are estimated at around $39 billion, (about 12% of its total exports), while its import bill for gold and oil amounts to around $135 billion (around $35 billion for gold; and $100 billion for oil), which is about 30% of its overall annual imports. India’s trade deficit stood at $137.5 billion in FY2013-14.

Fertilisers Fertiliser prices are dependent on gas production and impact food prices. Fertiliser prices are forecast to decline sharply by around 12% in 2014, mainly due to higher production and low production costs. WB says that fertiliser prices have bounced back by around 4.9% in Q3 2014, but are still down around 6% from year-ago levels, and down about 60% from the high levels of 2008. Encouraged by low natural gas prices in USA, several companies are planning to build new fertiliser plants there, including a European fertiliser company which is expected to become the world’s largest producer of nitrogen fertiliser. The WB Fertiliser Price Index is expected to decline 11.5% in 2014 and an additional 3.5% next year, says WB. “Phosphate rock and potassium chloride will decline almost 25% each in 2015, urea will average 6.5% lower, but TSP and DAP will make some moderate gains,” it adds. Agriculture International food prices have been on a downward trend since 2012 and this is expected to continue through 2015. According to WB, maize prices are likely to plunge 27% y-o-y in 2014, while rice and wheat prices will drop by 16% and 9% respectively. However, coffee (Arabica) and cocoa prices could increase, particularly if the Ebola outbreak spreads in West Africa, says WB. India The World Bank has already downgraded growth prospects for LAC countries due to low commodity prices. However, low gold, fertiliser and oil prices could help countries such as India reduce spending on imports. John Baffes, Senior Economist, World Bank’s Development Prospects Group, said, “Lower commodity prices will help ease balance of payments pressures in food and energy importing countries. However, commodity exporting countries may feel the pinch because of lower export earnings.” India is a top agricultural products exporter, but its economy is heavily reliant on gold and oil imports. Currently, India’s agriculture exports are estimated at around $39 billion, (about 12% of its total exports), while its import bill for gold and oil amounts to around $135 billion (around $35 billion for gold; and $100 billion for oil), which is about 30% of its overall annual imports. India’s trade deficit stood at $137.5 billion in FY2013-14.

This article was published on October 21, 2014.

to success.

to success.