Difficult times ahead for Indo-US trade?

Abin Daya

Sugar is becoming not so sweet for retail consumers, with prices rising fast in the domestic market. CPI inflation on sugar has remained in double digits for 10 months in a row now. The expectation for Feb 2016 is also not any different. In the global scene, while the prices may have dropped marginally during the recent months, they still remain high compared to the previous year levels.

However, the recently published Trade Policy Agenda of the US Administration for 2017 hints at changes that might lead to concerns for India. The US is India’s largest export market at $40 bn worth of exports per year. Any event which changes Indo-US trade dynamics and affects this number will have a significant impact on overall trade, and consequently, on our trade balance. The recent publication seems to suggest some concerns for India on this front.

US' Trade Policy Agenda

- Earlier this month, the Trump administration unveiled its Trade Policy Agenda for 2017 and Annual Report for 2016

- The Agenda for 2017 warns that the US will not be bound by WTO decisions if it deems them to be against American trade interests

- If the US follows through on the Agenda declarations, it might well lead to dismantling of the global trade organisation that it help build since the WW II

- The tone of the Agenda document suggests that the new government believes bilateral negotiation are more effective than multi-lateral deals

- This also brings to question the fate of the Trade Facilitation Agreement, the first multi-lateral arrangement brought in by the WTO, as I had also mentioned in an earlier issue of the weekly update

- More concerning for India is that the Agenda describes the various export subsidy programs as a cause of concern, which it will seek to dismantle through international and bilateral efforts

- Of particular concern to the US are the subsidy program for the textile and garments sector, which, it says, has achieved export competitiveness and hence is not eligible for export subsidy programs as per WTO guidelines

- The report also says that there is a general trend of tariff increase in India, which indicates pursuit of import substitution policies and gives the example of the steel industry to emphasise the point

- Along with India, the Annual Report targets other countries with which the US has a trade deficit, and these will be focus areas as the US looks to bring down its overall deficit

- India enjoys a large trade surplus of almost $19bn with the US, though the surplus has fallen marginally in FY16

.jpg)

- Looking at the composition of commodities, textiles & garments comprise a major portion of our exports to the US, and any disruption in this trade could impact our overall export numbers, and the industry in general, badly

Steel sector recovers strongly

- Extensive support by the government by way of curbs on import of various steel products has helped revive the steel sector after being battered for long

- Exports of finished steel grew by 150% in Feb 2017, over same month last year, to 0.756 MT, while imports were down by 46% y-o-y to 0.49MT

- For the Apr-Feb period, steel exports grew by 78% y-o-y to 6.62MT, while imports declined by 38.5% to 6.59MT

- With the figures coming in for Feb, India has become a net exporter of steel, this is expected to continue for March as well

- The strong export performance coupled with the drop in import volumes have helped improve domestic production, which has increased by 11% y-o-y during the Apr-Feb period

- Growth in domestic consumption, though, remains lacklustre at 3.4% y-o-y, resulting in usage of 76.23Mn tonnes

- With a view to improving domestic consumption, the government is in the process of bringing out a new steel policy, which will explore ways to improve production and consumption

- One of the objectives of the policy will be to double the per capita consumption of steel, which is currently at 61Kg, as against global per capita consumption of 208Kg

- As a first step, the government is expected to mandate the use of local steel in government infrastructure projects

- India has budgeted an amount of $59Bn for steel-intensive infra projects such as ports, roads, railways and power during 2017-18

- This step is expected to improve capacity utilisation of local steel producers, which currently stands at 75-80% of installed capacity

- The recovery in steel production also coincides with the recent surge in iron ore production, after roll-back of the mining ban in key producing areas

- The softening global prices of the raw material, combined with improved availability of domestic ore is expected to contribute positively to the bottom-line of steel manufacturers

Industrial growth improves to 2.7%

- India’s industrial output grew by 2.7% y-o-y in Jan 2017, compared to -1.6% in Jan 2016, and -0.1% in Dec 2016

- Some part of the growth could also be attributed to base effect, considering the decline in same month last year

- Considering the fluctuation in growth month-on-month, it is more meaningful to look at the year-to-date figures

- Growth in the manufacturing sector, which contributes more than 75% the weightage to IIP, has declined by 0.2% y-o-y

- This has dragged growth in the overall index to 0.6%, as against 2.7% during the same period last year

- Looking at the use-based classification, while capital goods grew at a healthy 10.7% y-o-y, intermediate and consumer goods grew by -2.3% and -1% respectively

- The growth in capital goods can also be attributed to favourable base effect, considering that growth in the segment had declined by 21.6% in the same month last year.

- In the manufacturing segment, items like Food & Beverages, Luggage & Footwear, Office Equipment & Computers registered significant double-digit decline y-o-y.

- Electrical machinery and communication equipment registered strong double-digit growth during the Apr-Jan period of FY17

- A few of the high negative growth contributors included HR sheets, Ship Building, Sugar, PVC Pipes, Molasses and Leather Garments

- High positive growth contributors included Cables, Fruit Pulp, HR coils, Telephones, including mobile Phones, and Antibiotics

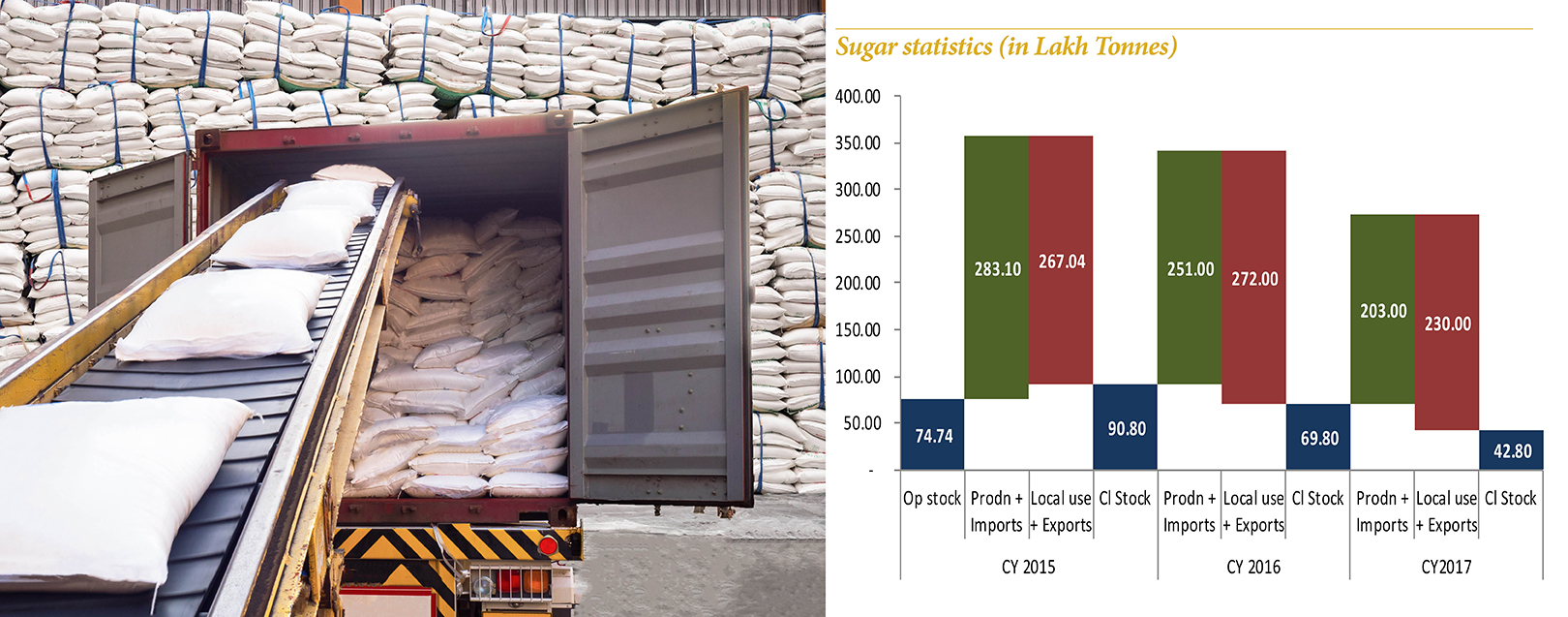

- India started the 2016-17 Cane Year (CY17) with an opening stock of 7Mn tonnes of sugar, 23% lower than the previous year

- With production being 11% lower than that of CY15 at 25.1Mn tonnes, and exports of 1.6Mn tonnes (+46%), consumption in CY2016 ate into the existing stocks

- Production during the on-going Cane Year (CY17) is expected to be significantly lower than the previous years, as cane yields in major crushing states such as Maharashtra and Karnataka were hit by drought

- As per the government estimates, production this year will be around 22.5 Mn tonnes, 10.3% lower than 25.1Mn tonnes produced in the previous CY

- However, industry body ISMA estimates production to fall by 19% this year, to 20.3Mn tonnes, which is 5% lower than the earlier estimate released in Jan this year

- The current production estimates, if true, will see India, the second largest producer in the world, producing lowest volumes in 7 years

Sugar output estimates dropped

- India started the 2016-17 Cane Year (CY17) with an opening stock of 7Mn tonnes of sugar, 23% lower than the previous year

- With production being 11% lower than that of CY15 at 25.1Mn tonnes, and exports of 1.6Mn tonnes (+46%), consumption in CY2016 ate into the existing stocks

- Production during the on-going Cane Year (CY17) is expected to be significantly lower than the previous years, as cane yields in major crushing states such as Maharashtra and Karnataka were hit by drought

- As per the government estimates, production this year will be around 22.5 Mn tonnes, 10.3% lower than 25.1Mn tonnes produced in the previous CY

- However, industry body ISMA estimates production to fall by 19% this year, to 20.3Mn tonnes, which is 5% lower than the earlier estimate released in Jan this year

- The current production estimates, if true, will see India, the second largest producer in the world, producing lowest volumes in 7 years

.jpg)

- Assuming NIL imports during the year, India will close the current CY with a stock of 4.3Mn tonnes, almost 40% lesser than that of last year, and barely sufficient for 2 months of local consumption

- Sugar currently attracts 40% import duty, and considering the situation and the possibility of price rises in the retail market, it is expected that the government will cut import duties and permit import of sugar from the global market

- The industry has been pushing to limit imports to about 400,000 to 500,000 tonnes even if the government permits the same, to ensure that the local manufacturers remain unaffected

- However, prices have also been rising in the international market, which might make it difficult for the government to find stocks at acceptable prices

- Above chart captures the highest level at which Sugar futures have found their daily close, during the past 24 months

- From its closing level of 13.64 cents/pound on Mar 02, 2015, prices have risen by 55% to close at 21.18 cents/pound on Feb 06, 2017

- While prices have dropped over the past few months from the highs they touched in Sep/Oct 2016, they still remain significantly high compared to where they were even 12 months back

- Sustained higher prices in the global market could also open up the opportunity for local manufacturers to engage with overseas buyers, despite the 20% export duty imposed to discourage exports

Some numbers to note*

*figures in brackets indicate movement during the week

- FX reserves: $364.01Bn as on Mar 03, 2017, as against $362.79Bn in the previous week (+$1.22n)

- USD/INR: Rs.66.6000/$ (INR appreciated by Re 0.21)

- Indian Crude Basket: $52.10 (-5%)/Rs.3,478.92 (-4.91%)

- Equity Markets: Sensex 28,946.23 (+0.39%); NIFTY 8,934.55 (+0.42%)

- LIBOR: 6 Mths – 143 bppa; 12 Mths – 182 bppa

- MIBOR: Overnight – 6.24; 1 month – 6.52; 3 months – 6.50

.jpg)

to success.

to success.