Feasible Fantasies Of T’vain’ty ‘Sick’steen?

Steven Philip Warner | January 2016 Issue | The Dollar Business

New Year is the least questioned, most celebrated event on the calendar. Yet it belongs to no country, religion or government. Even those who claim to be entwined in a thousand big ways with globalisation cannot change that. None can. The last time it occurred, over seven billion earthlings swore on matters personal and business. They bowed down to the ‘time’ god. Every year this mental ritual is observed. Reason: fear of the year to be that stems from one word that describes events that conditionally impact transition into a new calendar year: irreversibility!

Crystal gazing is always a fragile endeavour. It isn’t easy to bet everything on your hopes and prayers when it comes to real life, is it? That fact doesn’t change when you switch over from an individual to a corporation or even an economy. Which is what makes global trade so unpredictable. But some things are as easy to guess as India not winning more than two gold medals in the forthcoming Rio Olympics or Obama not becoming the US President for the third time. 2016 could mark such events, bound to change how business beyond boundaries will be treated. Here are some eventualities...

Oil will hit the $100 mark in 2016: Hear someone say this and you would assume more about that person’s perturbed state of mind than oil or 2016. For the first time in seven years, Brent crude futures fell below the $39 per barrel (pb) mark in December 2015. The last time this happened was when recession loomed large in 2008. Experts have started talking about oil price breaking a July 2004 low record, i.e. $30 pb. With OPEC continuing to pump out record volumes of oil (about 32 million barrel per day; mbpd), the US shale boom becoming more popular and other such factors, a continued weaker consumption in 2016 (presently, the world supplies 2 mbpd more oil than is consumed) will only mean weaker prices and instability for countries like Saudi Arabia, Kuwait, Qatar, Venezuela, Nigeria, Ecuador, etc. Bad news for oil producers is that if sanctions on Iran are removed, the world will see another one mbpd being added to its supply tank, worsening the glut. So in what range will oil prices oscillate? Between the floor support of $30 pb and ceiling of $60 pb. And $100 pb? Leave that for 2018.

The USDINR OTC Interbank exchange rate will fall below the 40 mark. Ever heard an annoyed Extraterrestrial (ET) talk currencies? This is perhaps what it would hope for on realising how alien-hunting and star-gazing groups are being funded to the tune of millions of dollars! The worst that the rupee fell to in relation to the dollar in all these years was 68.15, in September of 2013 (caused by heavy capital outflows from the Indian debt markets and doubts over the country’s macro-economic state). As on December 15, 2015, it closed at 67.10. With markets in the eurozone, Latin America, Africa and Asia still struggling to either handle deflationary pressures or infuse strength into their GDP muscles, and with US for a long time now playing on the minds of traders around the world with a Fed rate hike, the Indian rupee is only bound to fall to lower levels. [By the time you’d be reading this, chances are that the Fed would have raised rates by 0.25 bps.] If the Fed action causes capital flight, we would be looking at a bigger drop for the rupee, which could significantly alter profit margins for India’s export-import community. That’s the risk. Remember what triggered the Asian Financial Crisis of 1997? Undesired and unprecedented depreciation in local currencies across markets! Capital flight can temporarily damage a nation’s currency worthiness. And if the Fed, satisfied with inflation levels in the US market, decides to hike rates again in 2016, India should be well-prepared for the worst.

On an optimistic note, let’s just say that a fall in the rupee is good news for Indian export community. (For a long time now, RBI has wanted the rupee to depreciate in a manner as gradual, so as to give the needed edge to exporters while avoiding shocks for the economy.)

The problem of rupee falling against the dollar is more global an issue. It's not a policy fault on the part of the Indian bankers; just that the US dollar appreciated against all notable currenciesin 2015 – be it the euro, yuan, rouble, real, pound or even the Australian dollar.

Easy to imagine though that the thought of USDINR rate crossing over to the higher side of 70 in 2016 will hurt Indian importers. So they will be praying for a rupee bounceback. But to 40? 2016 could mean the USDINR exchange rate swaying in the range of 60 to 70. Anything beyond is difficult to imagine. But 40? Place a short trade on the USDINR currency pair only if you’re an ET!

India’s exports will explode by 100% y-o-y in 2016: That will be a miracle! We’ve heard judgments galore on China’s faltering exports ever since we first wished “Good morning!” in 2015, and overlooked India's shortcomings. Welcome to reality. November 2015 marked the 12th straight month of fall in merchandise exports for India in 59 years! In terms of absolute value, the $20 billion it recorded in exports in the month was a five-year low! Going by what has been reported for the first 11 months of 2015, India will end the year with merchandise exports in the range of $260 billion-$270 billion, marking a change of negative 17-20% y-o-y in total exports. If India’s exports shrink y-o-y in December 2015, it will be the first time in the past 59 years that a negative change in goods exports will have been recorded in all months in a single calendar year. An analysis by TDB Intelligence Unit proves that India’s total exports (merchandise and services) have to increase by 20% if the target of $900 billion in exports by FY2020 is to be met. Given a stiff target, India will have to pull up more than just its socks.

This calls for greater incentivised exports from the country till the time Make in India gets kicking. Higher and more meaningful Drawback Rates (the revised DBK rates notified in Nov 2015 were anything but impressive), greater incentives under MEIS and SEIS (and smoother procedures for exporters to claim rewards), etc., could play the doctors. Also, a policy such as allowing SEZs to sell goods in domestic market (DTAs) at FTA rates will not only ensure greater employment opportunities in India but will also help lower our import bill.

Optimism is justified in foreign trade, but going by the jaundice-struck state of affairs in markets around the world, a 15% y-o-y growth will prove heartening. 100%? Let’s not talk about 2026 yet.

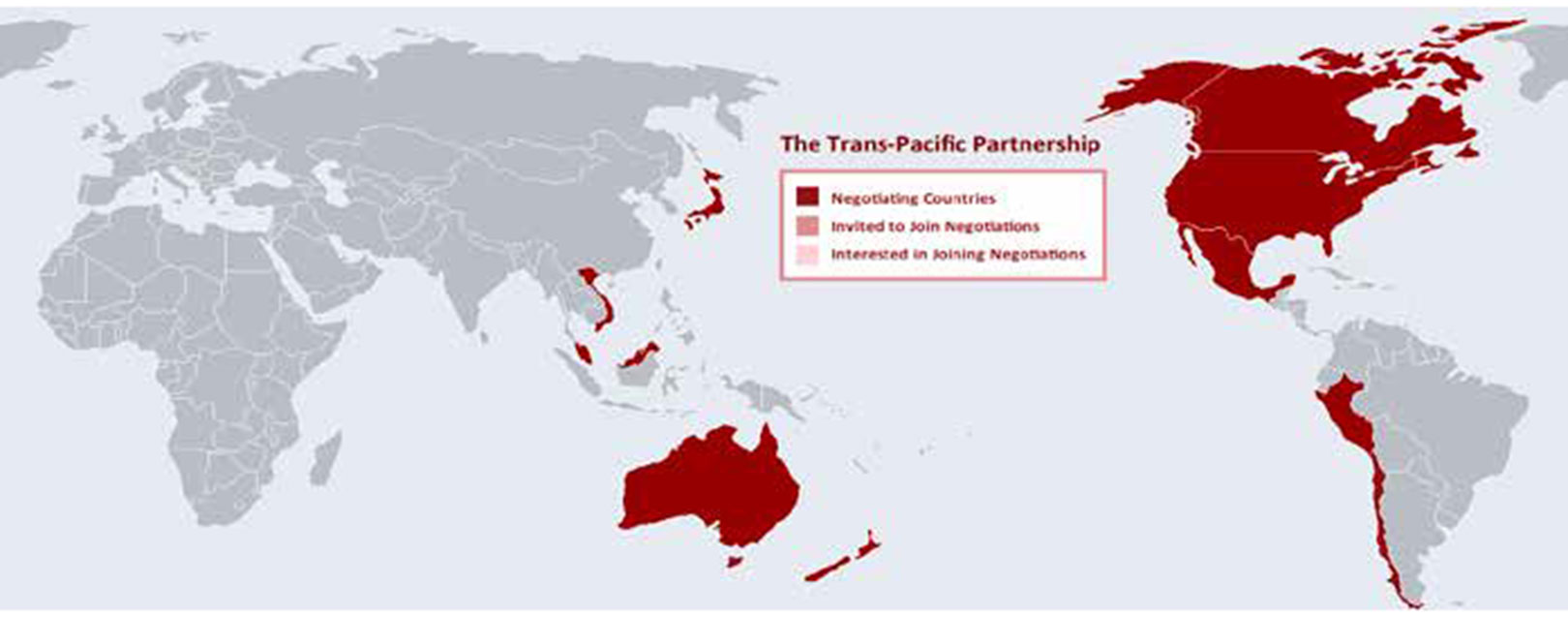

India’s ongoing FTA discussions will be concluded in 2016: There are plenty of false positives in the world. For India, FTAs is one.The Trans-Pacific Partnership (TPP) was signed in October 2015 by a dozen countries (led by US) after seven long years of negotiations. All along, India was hoping it would be invited to join the bloc. It didn’t get the call. We can continue debating over whether India qualifies to be a part of the FTA (given its stringent norms on IP regulation, binding regulatory provisions in services, transparency clauses, etc.), but that chapter is closed for now. All that US is doing now is giving presentations to our policymakers on how TPP may benefit India!

The Regional Comprehensive Economic Partnership (RCEP), is another planned FTA between India and the 15 other nations including China. The jury is still out on whether RCEP will benefit or damage India's domestic manufacturing industry, but what is critical to note is that the deal is not going through any time soon. As it stands, three rounds of negotiations for RCEP in 2016 have already been intimated to its members between February and June 2016. And if TPP with 12 members took seven years to be concluded, RCEP with 16 will need more than just five years. As it stands, India submitted its initial list of offer to reduce tariffs on some goods as late as second half of November 2015. With TPP reaching conclusion, RCEP may be headed the world’s way sooner than expected. But 2016? Please continue cheering...

Then there is India’s most ambitious bilateral trade agreement till date – the India-EU FTA. After more than 15 rounds of talks in the last eight years, this seems to be a marriage that’s fast appearing forced. To enumerate some – India doesn’t want to reduce tariffs on imports from EU in the auto, liquor and dairy products sectors. India is not comfortable opening up its banking, retail and telecom verticals. India is uncomfortable even considering the inclusions of labour and environment standards under the terms of agreement. Above all, India feels that its gain from the FTA is largely only in services. In short, the FTA seems more of a geo-political than a trade agenda for India. News is – the sides will meet in January 2016 to check if there is any pulse left in the negotiations on the trade front. Bet your best horses – you will see little happen on the agreement in the next eleven months.

Perhaps one calendar is too small a space for world leaders to please a nation or a bloc multiple times. This year, good news happened for Iran and TPP. If India is lucky, it may win some conclusion on the Doha Development Agenda (DDA) and write home some good news in the name of food security and special safeguard mechanism (SSM).

For the sake of jest, I could write down a few more issues that could but wouldn’t happen in 2016, for that would either mean welcoming 2026 far too soon or that we are no longer on Earth. How about these? “The Chinese yuan will become the most ‘trustworthy’ reserve currency, especially with reappearance of missing Chinese company bosses winning the nation’s currency and bourses global investor trust”, “Commodities like steel, aluminium, copper, lead and nickel will give 200% ROI in 2016”, “Putin will become America’s darling in 2016”, “Abu Bakr al-Baghdadi will nominate Bashar al-Assad to the Norwegian Nobel Committee for Nobel Peace Prize in 2016”, “Japan, Brazil, Australia, South Africa and Canada will see their GDP grow by 10% in 2016”, “Greece will grant China a bailout package of $1 trillion”; oh! If only foreign policy and macroeconomic occurrences were wishes...

Presently, world trade seems to have hit modest levels. And the world awaits that bombshell moment, that splashy economy, and that substantial quarter – all of which are unusual in mellowed times. But revival doesn’t always have to follow a V-shaped graph, and foreign trade doesn’t always need to rely on one nation.

Agreed. 2015 was a year more of caution, and international trade data for the best of performers of the 2010-2014 era seemed to be subdued at best and traumatised at worst. But sometimes, growth begins with healing. Healing in commodities, conflicts, currencies and creation (manufacturing)… And what globalisation hasn’t changed in decades is that the world that we live in, still has the capacity to do far more than just heal. It can become a better version of itself in 2016. Happy New Year!

to success.

to success.