Foreign Trade Policy has bigger objectives

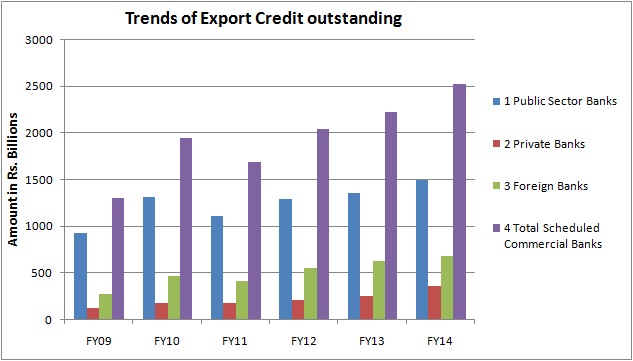

The total exports increased from US $ 274.55 billion in FY10 to US $ 465.90 billion by FY14 in a span of 5 years. As against a Compounded Average Growth Rate (CAGR) of 15.9 per cent of exports recorded between FY05 to FY14, the target of CAGR 11.5 per cent looks modest but as the base broadens, it requires tremendous efforts to galvanize and sustain the rising growth rate. Hence, in order to reach the targeted mark, the entire eco system has to fall in line to support export led growth in key sectors such as manufacturing, MSME, Agriculture and their interdependent sectors. Among many proactive measures, coming to the specifics, introduction of two new schemes are cited as unique clad with vision and foresight. The ‘Merchandise Exports from India Scheme’ (MEIS) is for export of specified goods to specified markets. The ‘Services Exports from India Scheme’ (SEIS) is for increasing exports of notified services. These replace multiple schemes earlier in place, each with different conditions for eligibility and usage of scrip(s). It has no conditionality attached to any scrip under these schemes. Duty credit scrip(s) issued under MEIS and SEIS, and the goods imported against these scrip(s), are fully transferable. The dawn of these two new schemes for export/import business entrepreneurs is a part of simplification and easy to implement process. 1. Export obligations brought down: Similarly in order to encourage procurement of capital goods from indigenous manufacturers under Export Promotion Capital Goods (EPCGs) Scheme, the Export Obligation (EO) has been reduced by 25%. The EO has now been reduced to 4.5 times of the duty saved instead of present stipulation of 6 times. The move is expected to go a long way in eventually working towards the goal of promoting ‘Make in India’ mission. This will promote the domestic capital goods manufacturing industry and enable them to develop their productive capacities for both local and global consumption. Further, there is a higher level of rewards under the MEIS for export items with high domestic content and value addition. In order to boost exports from Special Economic Zones (SEZs), government has now decided to extend benefits of both the reward schemes (MEIS and SEIS) to units located in about 200 exports oriented SEZs spread across. A number of steps have also been taken for encouraging manufacturing and exports under 100 per cent Export Oriented Units (EOU) Schemes. One hundred and eight MSME Clusters have been identified for focused interventions to boost exports. 2. Export Credit: In a bank led economy, every sector needs the support of the banks. The stance of the monetary policy of Reserve Bank of India (RBI) is well designed to provide sufficient credit to the productive sectors of the economy. Though not statutory, the export credit should be minimum 12 per cent of the total credit. But following data demonstrates that the pace of growth of export credit has not kept pace with the credit growth in the last few years.

Source: Report of Internal working group to revisit Priority Sector Lending (March 1, 2015) – Reserve Bank of India

Source: Report of Internal working group to revisit Priority Sector Lending (March 1, 2015) – Reserve Bank of IndiaThe bank’s export credit component has moved with lackluster focus in the last 5-6 years with a continuing low base as against around 14 -15 per cent of CAGR of bank credit. The focus seems to be missing to lend to the export sector which can now receive the kind of attention needed, once it is brought within the ambit of Priority Sector Lending (PSL) of the banks. Such tepid growth of export credit may be due to lack of systemic monitoring at different levels or unattractiveness to lend. 3. Internal working group of RBI In this context, according to an internal working group set up by RBI and given the importance of exports in the economy a focused attention is felt essential to step up export finance within the PSL. Thus, the Working Group recommends carving out a separate category of export credit under PSL to create a systemic device to step up credit to this vital sector. It recommends that incremental export credit from a base date (i.e. the outstanding export credit as on the date of reckoning minus outstanding export credit as on the base date) to units having turnover of up to Rs.100 crore and having sanctioned credit limit of up to Rs.25 crore from the banking system may be included in priority sector. The export credit under PSL may have a ceiling of 2 percent of Adjusted Net Bank Credit (ANBC) in order to ensure that other segments are not crowded out. Inclusion of export finance in PSL targets for banks has been a long standing demand of the Federation of Indian Export organizations (FIEO). With the accelerated flow of credit to export sector, faster implementation of FTP-20 can be facilitated. 4. Federal Vision of FTP-20 The ‘easy to implement’ measures contained in the FTP-20 have thus established a robust umbilical cord with the federal vision of ‘Make in India’ and ‘Digital India’ that can spruce the export competitiveness of Indian merchandise/services abroad. According to a World Bank report, manufacturing in India accounts for about 16 per cent of Gross Domestic Product (GDP), a level that has remained almost static for the past two decades. This is relatively subdued when compared to 20 per cent plus share in countries like Brazil, China, Indonesia, Korea and Malaysia (even after taking into account the differences in per capita incomes). According to McKinsey and Company, India’s manufacturing sector could touch US 1 Trillion by 2025 taking the share of manufacturing to account for 25 per cent share in GDP with a potentiality to create employment of about 90 million. Thus, if the benefits of the policy can reach the last mile, it has the potentiality to strengthen backward manufacturing linkages which are vital for India’s participation in Global Value Chains. Thus the FTP-20 is not merely to step up exports but has a larger objective to create a seamless policy environment that can steer multifaceted export led growth of the economy. In the process, it aims to increase India’s global share in export of merchandise and services from the existing 2 per cent to 3.5 per cent, thus making India play an accelerated role in facilitating international trade. The focus of the new policy is to support both manufacturing and services sectors, with a special emphasis on improving the ‘ease of doing business’ and trade facilitation. The Policy this time has also been accompanied by a statement explaining the vision, goals and objectives underpinning India's FTP making its approach and priorities more transparent to the stake holders. 5. Reforms in implementation: Marking the differentiation in approach, several entrepreneur friendly reforms are also proposed. Extensive use of information technology to facilitate claim of incentives and reduction of transaction costs is envisaged. Allowing uploading of scanned copies of documents in the website of Directorate General of Foreign Trade (DGFT) might begin the way towards paperless and hassle free transactions in due course. Similarly to keep a tab and call for greater collaboration to achieve targets, it is proposed to institutionalize an inter-ministerial mechanism to step up growth. The state governments will be called upon to coordinate and collaborate with the federal agencies to address and weed out impediments. Greater multilateral and bilateral trade pacts will aid the collaboration in driving the synergy of increasing interconnectedness with the global trade forums. Among other nuances, unlike the annual reviews of the past, the FTP-20 will now be reviewed after two-and-half years (midterm) to ensure continuity in the trade policy. It augurs well to lend more time to view its outcome as dissemination of any policy change takes time to percolate. 6. Conclusion: The new FTP-20 thus can bring about innovative transformation in improving India’s connect with the global trade arteries on a sustained basis. Way forward, it has the potentiality to make Indian exports more competitive in the global market space. The implementation of these comprehensive measures need to be seen in the broad context linking as continuity of series of other policy initiatives put in place through ‘Make in India’ mission, Skills development, Union Budget, Monetary policy of RBI and strengthening diplomatic ties going much beyond SAARC nations. Though there is no obvious mention of ‘Look East Policy’, the implementing agencies can scout for greater tie up with East Asia to step up exports and imports for the purpose of exports. Measures could also be initiated to make export credit more attractive to the lenders to ensure that enterprises do not lag behind due to the missing link with credit flows, which is the life line for productivity and sustainability. More than the cost, quick availability of credit for export entrepreneurs will be crucial if the synergy of the FTP-20 is to be fully harnessed. It is a well thought policy and meticulously designed to take the export performance to the next growth trajectory catapulting India’s global status among the league of exporting nations.

(*The author is Associate Professor at the National Institute of Bank Management (NIBM), Pune. The views are his own)

to success.

to success.