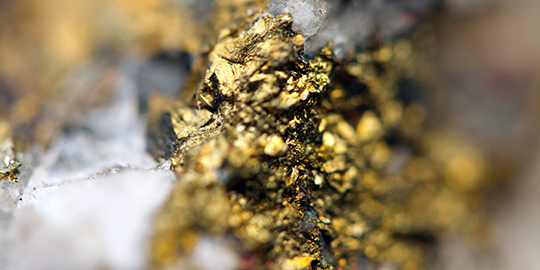

Government mulls over allowing import of gold alloy without licence

The government is in the process of softening licence norms for the import of gold-silver alloy in India. The import of gold-silver alloy used by refiners costs less than that of pure gold. Importers of impure form of the precious metal have to pay duties at 8.24% of the total value, whereas the duty on pure gold import is 10.30%. For bulk import of gold-silver alloy, also called 'dore', an importer needs to obtain licence from the Directorate General of Foreign Trade (DGFT), a wing of the Commerce Ministry. According to reports, the Reserve Bank of India (RBI) and the Finance Ministry are discussing ways to do away with the licencing requirement. While RBI is in favour of making 'dore' import free from any restrictions, the finance ministry is said to have expressed concern over the possibility of tax evasion by importers. Importers may tend to escape tax liabilities on the import of pure gold by showing it as a by-product of alloy, say officials. Licence was made mandatory to keep a check on the trade deficit by curbing the gold import in India which is the second largest buyer of the yellow metal. Ministry of Commerce data shows that the country imported gold worth $34.32 billion during the last financial year, registering an increase of almost 20% compared to the import value of $28.70 billion in 2013-14. Increasing gold import is a major factor behind the country’s trade deficit. On an average, India imports around 150 tonnes of 'dore' every year. Analysts say that restricted import of gold often triggers trade imbalance because of fluctuations in demand of the precious metal in the domestic market. Scrapping of licence for alloy import will be yet another move towards easing the gold imports in the country. Even though it will not help in curbing imports, the move can reduce the possibility of steep fluctuation of gold demand from Indian traders. In November last year, the government scrapped a rule under which importers had to offset at least 20% of their inbound shipment for exports.

July 4, 2015 | 3:26 pm IST.

to success.

to success.