India increases export funds to Iran to Rs.3000 cr

The Dollar Business Bureau

In order to boost the Indian exports to Iran, the government of India on Wednesday has increased the outlay of export funding to Rs.3000 crore from Rs.900 crore.

The move approved by the Union Cabinet was chaired by the Prime Minister by utilising the Export Development Fund (EDF).

"The proposal will promote the country's exports with Iran. It will also deepen India's relationship with Iran as a strategic partner," the government revealed in its official statement.

The increase in the funding to Rs.3000 crore would permit Exim bank to provide buyer’s credit facility to Iran which is secured via sovereign guarantee from India, for the export of goods and services.

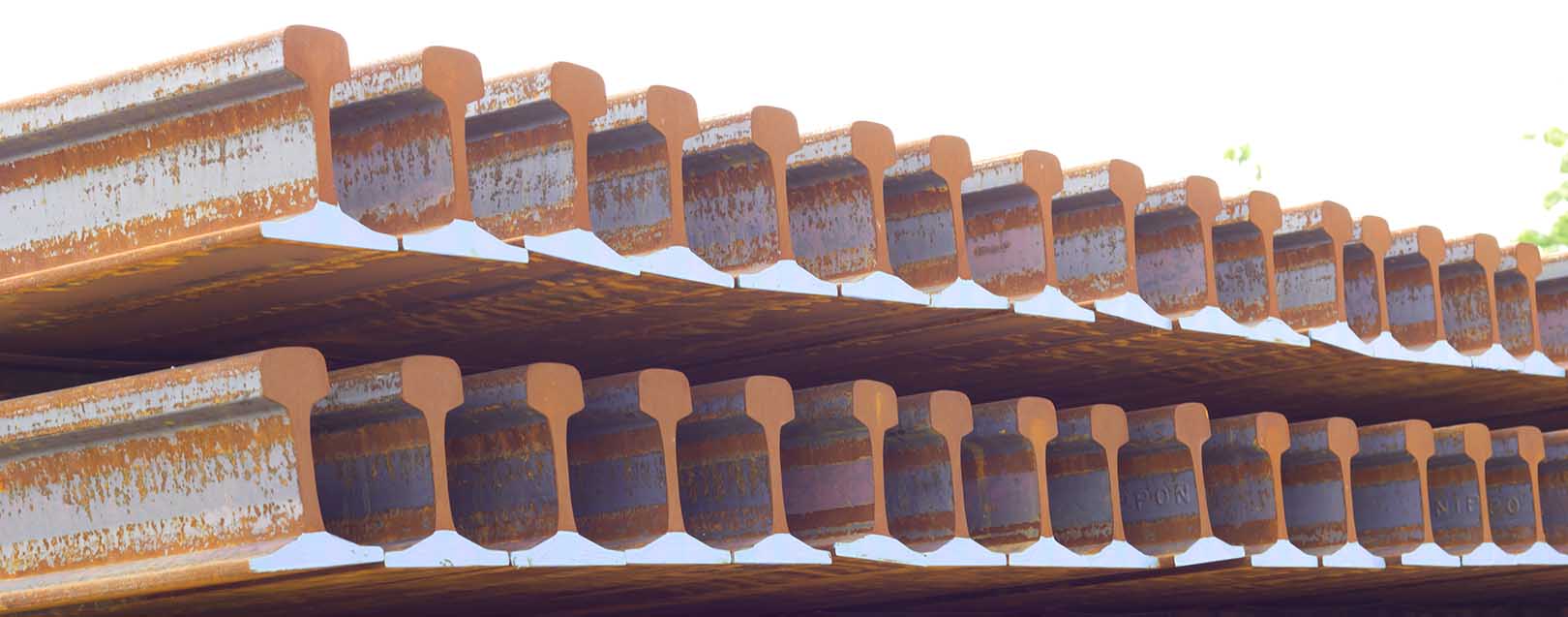

With the increase in this framework agreement between Exim Bank of India and a consortium of Iranian banks led by Central Bank of Iran, the proposal is expected to develop exports of steel rails bythe State Trading Corporation (STC), and the Chabahar Port Development project previously approved by the Cabinet under EDF.

Earlier last year, during a meeting with PM Modi in Russia, the Iranian President Hassan Rouhani had discussed issues related to Indian investment in Chabahar and the prospects of Indian investment in a special economic zone of Chabahar.

“This will provide an opportunity to Indian firms to enter and enhance their footprint in Iran along with facilitating the growing trade and investment with Iran. This will also help in employment generation and development of additional activities in India,” concluded the statement.

Meanwhile according to the Ministry of Commerce, India’s exports to Iran was around $4.17 billion in FY2014-15 while the country’s imports to Iran stood at $8.95 billion in the same year.

The bilateral trade between India and Iran in the fiscal year 2014-15 stood at $13.13 billion.

to success.

to success.