India ramps up rare earths production to meet Chinese challenge

Sai Nikesh D | The Dollar Business

Rare earths such as neodymium are used in laser manufacturing and hybrid cars

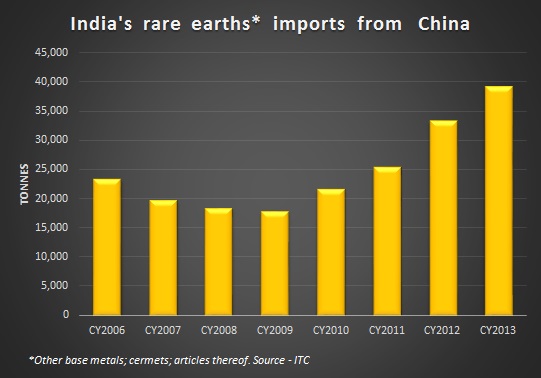

Rare earths such as neodymium are used in laser manufacturing and hybrid cars Several countries, including India, are beginning to tap into their rare earths reserves to ensure a steady supply and reduce the monopoly of China in the rare earths market. China’s dominance of the rare earths metals, key ingredients in the manufacture of a host of items from LED lights to smartphones to missiles, has gained much attention in the recent years. Concerns were partly addressed this month, when China removed some restrictions on rare earths exports following an order by the World Trade Organisation (WTO) last year. Experts say that the ruling has resulted in a sharp fall in rare earths prices in the international market. Dr. M.L.P. Reddy, Chief Scientist & Head, Materials Sciences & Technology Division, Council of Scientific & Industrial Research, India, told The Dollar Business, “China’s restrictions on rare earths were mainly intended to increase international prices and create a larger demand for its exports. However, the international prices for the rare earths have come down sharply, following the WTO ruling on China.” Dr. Reddy said that China will have to remove more restrictions on rare earths production and exports to maintain its place in the world rare earths market. However, several countries continue to look for alternative sources such as India. India is the second largest producer of rare earths with an annual production capacity of 2,800 tonnes, much below China’s 105,000 tonnes but ahead of Australia, Brazil and Malaysia which also produce rare earths. However, with its estimated reserves of over 3 million tonnes of rare earths, there is a huge potential for India to increase domestic production and become self-sufficient in the sector in future, said Dr. Reddy. Dr. Reddy added that India’s reliance on rare earth imports has grown in recent years, partly due to natural calamities in rare earths producing areas, but production is expected to increase in the coming months. Dependency on China for rare earth imports will also come down, as several nations like USA, Australia, Malaysia, Singapore, and India are planning to increase production, he said.  Indian Rare Earths Limited (IREL) is planning to set up a plant in Odisha by October 2015, with which India’s production of rare earths such as monazite and xenotime is expected to increase by up to 5,000 tonnes per year and increase India’s supplies in the international market by around 5%. IREL, in collaboration with Japan’s Toyota Tsusho company, is also planning to set up a plant in Visakhapatnam for the production of mixed rare earth materials from uranium and thorium ores, which Toyota Tsusho will use to produce neodymium for electric and hybrid cars, as well as lanthanum, cerium and praseodymium. This will further increase India’s rare earths production by about 2,000 tonnes to 2,300 tonnes annually, according to sources. According to Dr. Reddy, higher production is expected to make Indian rare earths competitive in the international markets, particularly in neodymium, the rare earth metal used in high power applications and laser manufacturing. He hopes that India will also become self-reliant in rare earths used to manufacture LED/CFL bulbs which the Indian government of India has been promoting to address power shortages in the country.

Indian Rare Earths Limited (IREL) is planning to set up a plant in Odisha by October 2015, with which India’s production of rare earths such as monazite and xenotime is expected to increase by up to 5,000 tonnes per year and increase India’s supplies in the international market by around 5%. IREL, in collaboration with Japan’s Toyota Tsusho company, is also planning to set up a plant in Visakhapatnam for the production of mixed rare earth materials from uranium and thorium ores, which Toyota Tsusho will use to produce neodymium for electric and hybrid cars, as well as lanthanum, cerium and praseodymium. This will further increase India’s rare earths production by about 2,000 tonnes to 2,300 tonnes annually, according to sources. According to Dr. Reddy, higher production is expected to make Indian rare earths competitive in the international markets, particularly in neodymium, the rare earth metal used in high power applications and laser manufacturing. He hopes that India will also become self-reliant in rare earths used to manufacture LED/CFL bulbs which the Indian government of India has been promoting to address power shortages in the country.

This article was published on January 17, 2015.

to success.

to success.