No MEIS benefit on guar gum products is impacting its exports

Aamir H Kaki

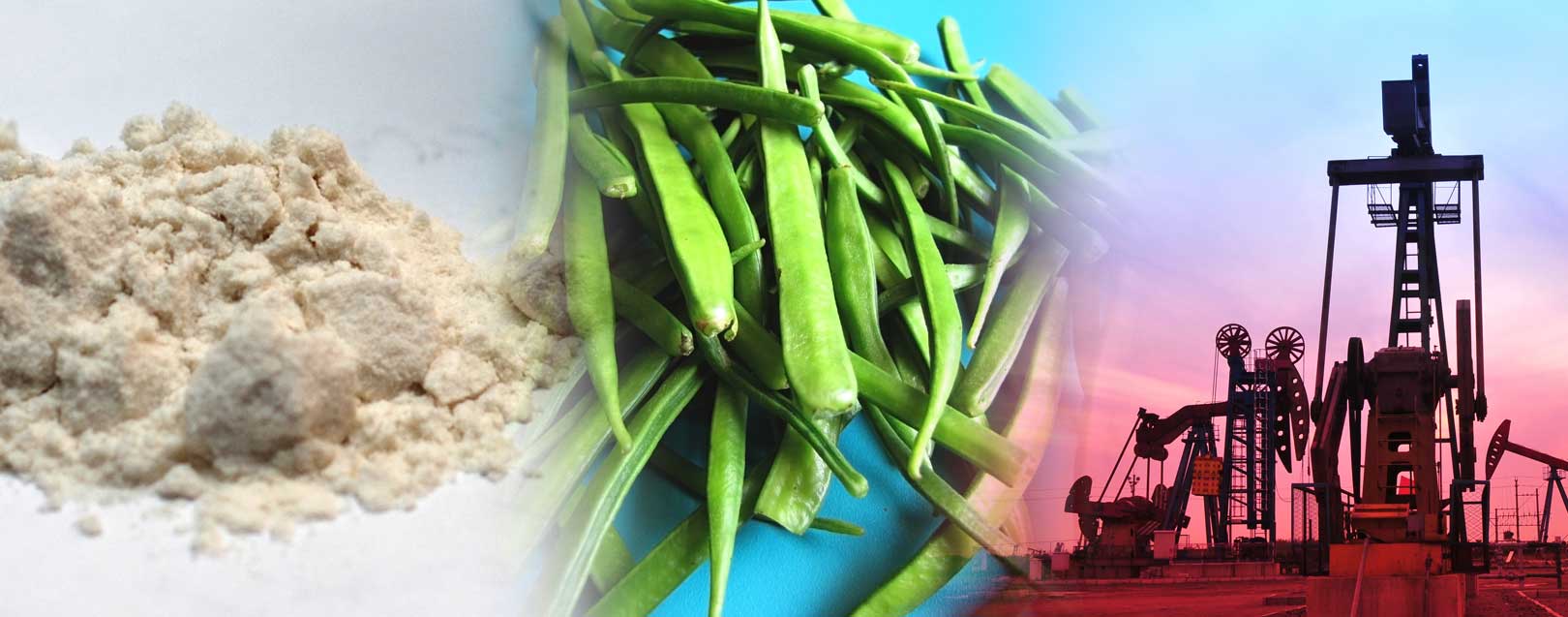

The modest and humble guar gum, a low-value crop grown on marginal land got transformed into one that can generate substantial income for farmers in recent years. The modest seed mostly harvested in the tropical regions of India (Rajasthan, Haryana and Gujarat) and Pakistan, used as a food crop for animals, gained international fame due to its viscosity. The innocuous looking seed/powder transformed into a product that can generate substantial income for processors, manufacturers, traders and farmers.

Owing to its usefulness in food, paper, textile and in the gas and oil industries India’s export of guar gum powder, saw a steep increase from a mere $84.7 million in 2001-02 to $3,930 million in 2012-13, becoming the largest agricultural export in the country. However, two years later, the value of India’s exports of guar gum plunged to $1,574, owing to a unit price decline.

The outlook for guar in the long term is viewed as optimistic, based mainly on the large and sustained demand the product particularly in North America due to the shale revolution. India could see the product’s export prospects brighten further with the emergence of China as a large export destination for Indian guar products. China now has the largest technically recoverable shale gas resources in the world and it aims to substantially increase its shale production in the coming years. The demand for the product is likely to be pushed up further across the world by the expansion of the processed food industry, which is the second largest user.

However, in recent times due to various international and domestic factors guar gum exporters in India were facing slow growth in exports. Stiff competition from other countries like Pakistan, Italy, US and Spain dented its numbers but with the removal of MEIS benefit in March by the Ministry of Commerce the industry was in for a severe setback.

The deletion of MEIS benefit on flour, meal and powder of guar seeds by the government impacted the business and exports of the industry in a major way. Speaking to the Dollar Business, Farooq A Valiulla, of Abdullabhai Abdul Kader – a government recognised export house, said, “It has already impacted the business. We are becoming uncompetitive a little bit. We are not able to get the incentives under the MEIS scheme. If it is included in the MEIS list we would be more competitive to sell our products globally. We have to face competition from other countries. Though India is one of the largest exporters of guar gum products, we still have to face competition from other countries,” he added.

Being the major exporter of guar gum to the world, India witnessed a downward trend in the exports of guar gum products in the past few years.

The export of flour and meal of guar seeds stood at Rs. 5,680.41 lakh in 2014-15, a decline of 16.89% as compared to Rs.6,834.52 lakh in the previous year. However, the exports once again saw a marginal increase of Rs. 8,166.38 lakh during the April-February period of 2016-17.

When asked for the reason for the rapid decline in the exports of the product, Valiulla said, a low demand from India’s major buyer, US contributed to its dismal export figures. With the US increasingly looking to alternative energies, the market for guar gum could be impacted further. “If the US shifts its dependency on fossil fuels then it would definitely impact the trade of guar gum – which is majorly used in petroleum industry,” he added.

The consumption trend of guar gum and seeds is mainly influenced by the demand from the petroleum industry. The fall in crude oil price, which was ruling at a high of $107 per barrel in 2013 and is now below $50 per barrel, has decreased oil exploration which again translated into weak exports of guar gum from India.

The reduction in numbers is not only due to a weak export demand, India’s internal factors are also impacting the exports of the product.

“Guar gum has an inherent problem with price fluctuations. When the prices go very high, the industry is unable to adjust itself. The rising guar gum prices and fluctuation in prices within the country have also impacted the trade,’ Valiulla explained.

When enquired about exploring new markets, he said, “Though the US is our major market, we are in the process of reaching out to Africa, for our future exports.”

India exports various types of guar products to many countries. It has exported 3,25,250.71 MT of guar gum, worth Rs. 3,233.87 crores during the financial year 2015-16.

Around 90% of guar gum processed in India is exported. The major export markets are US, China, Germany, Russia and Canada. If the Indian government could once again include the product under the MEIS scheme, take measures to strengthen the regulatory framework of the product on the commodity exchanges, provide proper marketing avenues to the farmers and take care of the logistics facilities of transporting the product from the industrial hubs to the ports, the future prospects of the industry and its exports could brighten up.