Sunset Review anti-dumping investigation concerning imports of Acetone originating

No.15/29/2014-DGAD

GOVERNMENT OF INDIA

MINISTRY OF COMMERCE & INDUSTRY

DEPARTMENT OF COMMERCE

(DIRECTORATE GENERAL OF ANTI-DUMPING & ALLIED DUTIES)

Final Finding

Subject: Sunset Review (SSR) anti-dumping investigation concerning imports of Acetone originating in or exported from Japan and Thailand.

Having regard to the Customs Tariff Act, 1975, as amended from time to time (hereinafter also referred to as the Act) and the Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules 1995, as amended from time to time (hereinafter also referred to as the Rules) thereof;

A. Background of the Case

1. Having regard to the above Rules, the Designated Authority had initiated the original investigation concerning imports of Acetone, originating in or exported from Japan and Thailand, vide Notification No. 14/31/2009-DGAD dated 3h1 September, 2009. The Designated Authority notified the Preliminary Findings recommending provisional anti-dumping duties on 16th February, 2010. Provisional duties were imposed vide Customs notification no. 45/2010- Customs dated 9th April 2010. The Final Findings Notification was issued by the Authority on 19th January, 2011 recommending imposition of definitive duty on the imports of the subject goods, originating in or exported from Japan and Thailand. Definitive anti-dumping duties were imposed by the Department of Revenue vide Notification No. 36/2011-Customs, dated 18th April, 2011, for a period of 5 years from 9th April 2010, i.e., upto 8th April 2015.

2. M/s Hindustan Organic Chemicals Limited (hereinafter also referred to as HOCL), M/s SI Group India Ltd (hereinafter also referred as SI Group), filed a combined application before the Designated Authority for initiating a combined sunset review of the antidumping duties on import of Phenol and Acetone from Thailand and Japan, imposed vide Notification No.120 /2010-Customs dated 1st December 2010 and No. 36/2011-Customs dated 18th April, 2011. The petitioners alleged likelihood of continuation of dumping of the above goods, originating in or exported from Japan and Thailand (herein after referred to as the subject countries) and consequent injury to the domestic industry and requested for review, continuation and enhancement of the anti-dumping duties, imposed on the imports of the subject goods, originating in or exported from the subject countries.

3. In accordance with section 9A(5) of the Act, read with Rule 23 of the Anti-dumping Rules, the Authority initiated a sunset review investigation, vide Notification No. 15/29/2015-DGAD dated 7th April, 2015 to review the need for continued imposition of the anti-dumping duties in respect of Acetone (hereinafter also referred to as the subject goods), originating in or exported from the subject countries, and to examine whether the expiry of the said duty is likely to lead to continuation or recurrence of dumping and injury to the domestic industry. The duty was extended by the Department of Revenue till 8th April 2016, vide notification no.16/2015-Customs (ADD), dated 22nd April 2015. The time period for completion of the investigation and notification of final finding of the Authority was extended by the Central Government till 6th July 2016, in terms of Rule 17of the Rules.

4. Apart from the subject countries, antidumping duties are also in force on the subject goods originating in or exported from the European Union, Singapore, Korea RP, Chinese Taipei, USA, South Africa and Saudi Arabia. The scope of the present review is with respect to the duties in force on the imports of the subject goods, originating in or exported from Japan and Thailand and covers all aspects of the previous investigation.

B. Procedure

5. The procedure described below has been followed with regard to the subject investigation:

i. The Embassies of the subject countries in New Delhi were informed about the initiation of the sunset review investigations in accordance with Rule 6(2).

ii. The Authority provided copies of the non-confidential version of the application to the known exporters and the Embassies of the subject countries in accordance with Rules 6(3) supra. A copy of the non- confidential version of the application was also made available in the public file and provided to other interested parties, wherever requested.

iii. The Authority forwarded copies of the public notice to the following known manufacturers/exporters in the subject countries (whose names and addresses were made available to the Authority by the petitioner) and provided opportunity to make its views known in writing within forty days from the date of the letter in accordance with the Rules 6(2) & 6(4).

i. PTT Phenol Co., Ltd. (PPCL)

ii. Chiba Phenol Co. Ltd. Shiodome

iii. Mitsubishi Chemicals

iv. Mitsui & Co., Ltd. (“MBK”), Japan

v. M/s Mitsui & Co. (Asia Pacific) Pte. Limited, Singapore

vi. Mitsubishi Chemical Corporation (“MCC”)

vii. Sunitomo Corporation

viii. Mitsui Chemicals, Inc

iv. The following producers/exporters of the subject goods in the subject countries have filed their questionnaire responses

1. M/s PTT Phenol Company Limited, Thailand (Producer)

2. M/s MITSUI & CO., LTD., JAPAN, (Exporter)

3. M/s MITSUI & CO. (ASIA PACIFIC) PTE. LTD., Singapore (Exporter)

v. The Authority forwarded copies of the public notice to the following known importers/consumers (whose names and addresses were made available to the authority by the applicants) of subject goods in India and advised them to make their views known in writing within forty days from the date of issue of the letter, in accordance with the Rule 6(4):

1. M/s. C.J. Shah and Company

2. M/s Haresh Kumar & Co., Mumbai

3. M/s. PCL Oil & Industries

4. M/s Kantilal Manilal & Co. Pvt. Ltd.

5. M/s Sonkamal Enterprises, Mumbai

6. M/s. Khetan Brothers

7. M/s. Shubham Dyes & Chemicals Limited

8. M/s Acron Enterprises

9. M/s. Naiknavare Chemicals Limited

10. M/s. Paras Dyes & Chemicals

11. M/s. Torrent Pharmaceuticals Limited, Gujarat

12. M/s. United Phosphorus Ltd., Mumbai

13. M/s. Resins & Plastic Ltd.

14. M/s. Kailash Polymers

15. M/s Centrum Metalics Pvt. Ltd.

16. M/s. Wonder Laminates Pvt. Ltd.

17. M/s. Meghdev Enterprises

18. M/s. Satguru International

19. M/s. Bleach Marketing Pvt. Ltd.

20. M/s. Karmen International (P) Ltd.

21. M/s. High Polymer Labs Ltd.

22. M/s. Rainbow colours & Chemicals

23. M/s. Krishna Antioxidants Pvt. Ltd.

24. M/s. NGP Industries Ltd.

25. M/s. Farmson Pharmaceutical Gujrat Ltd.

26. M/s. India Glycols Ltd.

27. M/s. Singh Plasticisers and Resins (I) Pvt.

28. M/s. National Plywood Industries Ltd.

29. M/s Kundan Rice Mills Ltd.

vi. None of the importers of the subject goods has filed any questionnaire response or made any substantive submissions in this matter.

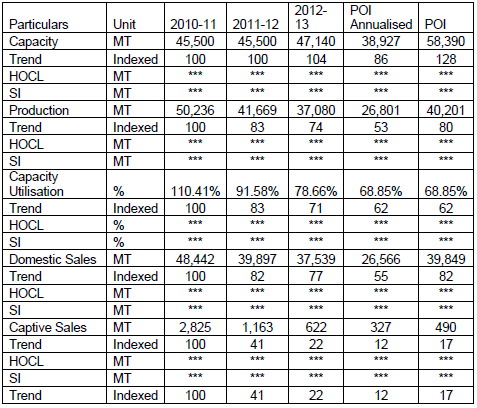

vii. The Period of Investigation (POI) for the purpose of the present review investigation was April 2013 –September, 2014 (18 months). The examination of trends in the context of injury analysis covered the periods 2010-11, 2011-12, 2012-13 and the POI.

viii. Transaction-wise imports data for the period of investigation and preceding three years was, procured from the Directorate General of Commercial Intelligence and Statistics (DGCI&S), has been relied upon for the analysis in this investigation.

ix. Exporters, producers, importers and other parties concerned with the subject goods, who have neither responded to the Authority, nor supplied information relevant to this investigation, have not been treated as interested parties in this investigation.

x. The Authority made available non-confidential version of the evidence presented by interested parties, in the form of a public file kept open for inspection by the interested parties as per Rule 6(7).

xi. The Authority has examined the information furnished by the domestic producers to the extent possible on the basis of guidelines laid down in Annexure III of the Rules to work out the cost of production and the non-injurious price of the subject goods in India so as to ascertain if anti-dumping duty lower than the dumping margin would be sufficient to remove injury to the domestic industry.

xii. The Authority provided opportunity to all interested parties to present their views orally in public hearings held on 20th January 2016. All the interested parties attending the hearings were requested to file written submissions/rejoinders of the views expressed orally.

xiii. The submissions made by the interested parties during the course of this investigation have been examined and addressed in this finding.

xiv. The Authority, during the course of investigation, satisfied itself as to the accuracy of the information supplied upon which these findings are based. The Authority conducted on-the-spot verification at the premises of the domestic industry and the cooperating producers and exporters to the extent considered relevant and necessary. Additional/supplementary details regarding injury were sought from the domestic industry, which were also received.

xv. Information provided by the interested parties on confidential basis was examined with regard to sufficiency of the confidentiality claims. On being satisfied, the Authority has accepted the confidentiality claims wherever warranted and such information has been considered as confidential and not disclosed to other interested parties. Wherever possible, parties providing information on confidential basis were directed to provide sufficient non confidential version of the information filed on confidential basis.

xvi. In accordance with the Rules the Authority issued a disclosure statement containing all essential facts of the case on 17.06.2016 for the comments of the interested parties. The comments of the interested parties, to the extent they are relevant, have been addressed in this finding in appropriate places.

xvii. *** in this finding represents information furnished by an interested party on confidential basis and so considered by the Authority under the Rules.

xviii. The exchange rate for the POI has been taken by the Authority as Rs.60.76 = 1US$.

C. Scope of Product under consideration and like article

6. The product under consideration in the Final Findings of the original investigation of Phenol dated 8th October, 2010 was described as follows:

“The product under consideration is ‘Acetone’. The Acetone is organic chemical also known as Dimethyl Ketone and used in manufacture of bulk pharmaceuticals, agro chemicals, dye stuffs, certain explosives and downstream chemicals. Acetone is classified under Chapter 29 of Custom Tariff Act under sub-heading 29141100. It is a basic organic chemical produced in single grade. It is a colourless liquid. It is used in numerous organic syntheses either as a solvent or as an intermediate. Acetone is specifically used in manufacture of Isophoron, Diacetone, Alcohol, Methyl Methacrylate and Bisphenol A. Besides this it is used in manufacture of certain rubber chemicals or Oxy Acethylene Cellulose Acetate and also a solvent in the manufacture of paints/coatings. It is marketed in two formsloose bulk and packed”.

7. Petitioners have submitted that Acetone produced by them are like article to the Acetone imported from the subject countries in terms of physical and technical characteristics, manufacturing process and technology, functions and uses, product specifications, pricing, distribution and marketing, and tariff classification of the goods. The imported products and the domestically produced goods are technically and commercially substitutable, and consumers use them interchangeably.

8. The product under consideration is classified under classified under Chapter 29 of Custom Tariff Act under sub-heading 29141100.

9. No relevant submission has been made by the producers/exporters/ importers/other interested parties with regard to the scope of the product under consideration (PUC) and like article. This being the sunset review investigation, the Authority holds that the scope of the PUC in the present investigation remains the same as that of the original investigation.

D. Domestic Industry and Standing

10. As noted earlier the petition for the sunset review of the antidumping duty on Phenol and Acetone was filed by M/s Hindustan Organic Chemicals Limited (HOCL) and M/s SI Group India Ltd. (SI Group). The Petitioners are the only producers of Phenol and Acetone in India and therefore, account for total Indian production. At the stage of initiation, it was submitted by the petitioners that M/s SI Group had imported these goods from several countries, including subject countries, both under duty free and duty paid schemes for captive consumption only and the imported goods were not sold in the domestic market. Pending further inquiry, the Authority, considered, at the stage of initiation, SI Group as an eligible domestic producer to be a constituent of domestic industry.

D.1 Views of the opposing interested parties

11. The opposing interested parties, in their submissions, have strongly argued for exclusion of SI Group from the scope of domestic industry for the purpose of the injury investigation and have inter alia submitted:

i. That SI Group has been excluded from domestic industry in the past on account of imports, which have been made in the present investigation also in the POI. It has been submitted that out of several investigations carried out by the Designated Authority, in most of the original investigations SI Group had been excluded from the scope of the domestic industry on account of imports. Therefore, SI Group’s participation in this anti-dumping investigations has been highly inconsistent.

ii. That imports of SI Group account for large share of production and sales made by domestic industry. SI Group has imported from sources of alleged dumping and has benefitted by trying to shield itself by partaking in dumping activities.

iii. That whether the imports are for captive consumption or commercial sales is irrelevant since any imports directly or indirectly impact the commercial market in India. Even if SI Group used most of imports for captive consumption, it freed up production and inventory of the product under consideration for commercial sales, while also at the same time ensuring that the captive consumption was substituted by cheap dumped imports.

iv. that while it is undisputed that the Hon'ble Designated Authority has complete discretion to include a domestic producer which is also an importer, this discretion must be moored on the touchstone of reasonableness and equity. Therefore, the inclusion of SI Group as domestic industry must be based on a rational and objective examination of facts.

v. That in plethora of cases decided by the Authority in the past (Anti-dumping investigation concerning imports of ‘Viscose Staple Fibre excluding Bamboo fibre’ originating in or exported from China PR and Indonesia- 2010; Soda Ash originating in or exported from China PR, European Union, Kenya, Iran, Pakistan, Ukraine and USA- 2012; Mid-term Review (MTR) Anti-Dumping investigation concerning imports of ‘Carbon Black used in rubber applications’, originating in or exported from China PR, Australia, Russia and Thailand -2013, Electrical Insulators-2015, etc. ) the issue has been decided by the Authority based on certain principles. In the light of the earlier precedents involving similar situations faced by the Authority, the key parameters typically examined by the Authority for exercising its discretion while excluding or including a domestic producer from the ambit of “domestic industry” are as follows:

a. Quantum of Imports in Comparison to Production and Sales;

b. The level or long term nature of the commitment shown by the producer to the domestic production, as opposed to importing activities;

c. If inclusion of a domestic producer would distort the injury findings, it must be excluded.

vi. That by juxtaposing the above information on SI Group with the identified parameters for the Authority to exercise its discretion, the following relevant factors would emerge:

d. The imports made by SI Group account for a large share of not just production but also sales made by the domestic industry.

e. As is evident from the data that its imports from countries subject to antidumping duties/ongoing investigations are over 37% of the total production of SI Group.

f. Therefore, it is undisputed that SI Group has not just imported from sources of alleged dumping, but also benefitted from the alleged dumping and in the process shielded itself by partaking in the dumping activities.

g. The current activities of SI Group are merely a continuation of a long standing trend as also recognized in the previous investigations carried out by the Authority, whereby it is clear that SI Group has had a long commitment towards importing the product under consideration from sources of alleged dumping.

vii. That the Authority may segregate and analyse the imports made by SI Group into duty paid and duty free imports and the impact thereto on its operations and margins, and make the same available for the interested parties so as to allow them to make meaningful submissions in this behalf.

viii. That in light of the above, the Authority should exercise the wide discretion accorded to it under the Anti-dumping Rules in a judicious manner in consideration of the facts and evidence before it and excluse SI Group from the scope of the doemstic industry for the purpose of the injury examination.

D.2 Views of the Petitioners

12. The petitioners, in their submissions, have argued that the petitioners in the present investigation namely, M/s Hindustan Organic Chemicals Limited and SI Group India Ltd, are the only producers of the product under consideration in the country. Although M/s SI Group India Ltd has imported subject goods these imports are not from the subject countries. Moreover, these imports have been made under duty exemption scheme for export production of downstream products. The company hasn’t imported for trading purposes and therefore this behaviour should not be considered as causing injury to domestic industry. It has been further argued that since imports by SI Group pertain to non-subject countries, they are not relevant for present investigation.

13. It has been further argued that the Designated Authority, in various Acetone and Phenol cases, has held that whether imports are for captive consumption or commercial sales is an important distinction. However, notwithstanding the above should the Authority consider that SI Group cannot be a part of domestic industry the Authority can exclude SI Group from the scope of domestic industry and proceed on the data/information pertaining to M/s HOCL alone.

D.3 Examination by the Authority

14. The Authority has examined the issue of eligibility of M/s SI Group to be treated as a part of the domestic industry for injury examination in the light of the above arguments put forth by the interested parties, the extant Rules and the jurisprudence evolved on the issue.

15. The Authority notes that SI Group and HOCL filed a combined application for initiation of a combined sunset review investigation covering both the products as the domestic industry, countries involved and period of investigation were same for both the products. At the time of investigation SI Group claimed that they had imported certain quantities of Phenol during the proposed POI from various countries under duty exemption schemes for export production and certain quantities were imported, from various countries, including the countries under investigation, with payment of applicable duties for captive production of downstream products. The Company further declared that they imported certain quantities of Acetone under duty exemption schemes for export processing. It was declared that they have not sold any imported goods in the domestic market. Based on these declarations SI Group was included in the scope of the domestic industry at the time of initiation pending further inquiry into the issue.

16. During course of the investigation it has been found that during the POI SI Group imported 12246.43 MTs of Phenol out of which 7455.732 MTs were imported under duty exemption schemes for export production and remaining 4745.346 MTs were imported duty paid. Out of the duty paid imports 45.35 MTs were sold in the domestic market. It is further noted that all the imports are from countries attracting antidumping duty and 800 MTs have been imported from Thailand, which is one of the countries under investigation in this case. The imports of this Company are about 23% of its own production of Phenol during the POI. Similarly, SI Group imported 9924 MTs of Acetone under duty exemption schemes for export production. It is further noted that all the imports of Acetone are from countries attracting antidumping duty though no imports have been made from the countries under investigation. The imports of Acetone are about 30% of its own production during the POI.

17. The Authority further notes that in its submissions as recorded above the Company had argued that since imports by SI Group pertain to non-subject countries they are not relevant for present investigation. It has been further argued by the petitioners that SI Group did not import the goods for trading purposes and therefore, this behaviour should not be considered as causing injury to domestic industry though about 45MTs of duty paid Phenol imported by this Company was sold in the market during the POI. Investigation also reveals that SI Group continues to import substantial volumes of both Phenol and Acetone during the post POI period of these two investigations. The past history of the Company also shows that they have been consistently importing the goods for their own consumption.

18. With this factual position of the case the Authority turns to the definition of the domestic industry and the discretion available to it under the extant Rules. Rule 2(b) of the Antidumping Rules provides as under:

2. (b) "domestic industry" means the domestic producers as a whole engaged in the manufacture of the like article and any activity connected therewith or those whose collective output of the said article constitutes a major proportion of the total domestic production of that article except when such producers are related to the exporters or importers of the alleged dumped article or are themselves importers thereof in which case the term 'domestic industry' may be construed as referring to the rest of the producers”

19. In the instant case one of the complaining domestic producers, i.e., SI Group, has been importing of both Acetone and Phenol for its captive consumption largely for export production. This fact was also before the Authority in the earlier investigations and this Company was included in the domestic industry in certain cases and in certain other cases it was excluded in the factual matrix of those cases. It is now established position of the law and jurisprudence evolved in other investigating authorities that Article 4.1 of ADA and Rule 2(b) of Antidumping Rules do not provide for the automatic exclusion of producers which themselves import the dumped products, but rather obliges the Authority to examine on a case-by-case basis whether the inclusion or exclusion of any producer in such a situation is warranted. In deciding whether to exclude a domestic producer from the scope of the domestic industry, the Authorities generally examine the following factors:

Whether the imports are sporadic and small compared to its own production and sales, not a regular phenomenon;

Whether the imports are necessitated to tide over certain situations, say production issues; or supplementing the grades not manufactured by it; or quality testing and product development etc.;

Need for completing their product range so as to be able to satisfy demand;

Whether there is no other viable domestic producer to be defined as domestic industry.

20. The discretion available to the Authority under Rule 2 (b) has been used in the past with due circumspection in situations where the complaining producer is the only domestic producer or the imports are not very significant in comparison to their production and sale and/or imports are meant for product development and testing etc. In the instant case, SI Group has been importing the subject goods in significant quantities though it has been submitted that major portion of the goods are being imported for its downstream production for export sales. Further, a small quantity of the imports has been sold in the domestic market and this fact was not brought to the notice of the Authority at the time of initiation. However, the Authority notes that there is only one other domestic producer in the country in the public sector i.e., M/s Hindustan Organic Chemicals Ltd.(HOCL) with significant production capacities. But the production facilities of HOCL has been on and off out of production and operated only for few months during the POI because of certain other factors though the domestic industry has argued that the production of this producer has been significantly affected by several factors, including prolonged dumping from various sources leading to closure of the plant for a considerable period during the POI. In this situation if SI Group is disallowed to be a part of the domestic industry for the purpose of injury examination, there will be practically no viable domestic industry to evaluate the injury and injury investigation will be significantly skewed or would not enable a reasonable analysis of the impact or likely impact of the imports from the subject countries.

21. In view of the above situation, the Authority is inclined to use the discretions available to it under Rule 2(b) with due circumspection and considers SI Group as a part of the domestic industry for injury examination in this case.

22. The opposing interested parties, in their post disclosure submission, have commented that the Authority has taken a step in the right direction by examining several factors in deciding whether to exclude a domestic producer from the scope of the domestic industry. However, In spite of analyzing the above factors, the Authority has decided to exercise its discretions available to it under Rule 2(b) with due circumspection and has determined that SI Group constitutes Domestic Industry, simply because if SI Group is disallowed to be a part of the domestic industry for the purpose of injury examination, there will be practically no viable domestic industry to evaluate the injury and injury investigation will be significantly skewed or would not enable a reasonable analysis of the impact or likely impact of the imports from the subject countries. This might set a perilous precedent, whereby the Indian manufacturer will always find a way to qualify as domestic industry despite importing the subject goods and benefitting out of such imports. It has been further argued that the imports made by SI Group have had a substantial impact on the domestic market in India, even if they were mostly utilized for downstream exports. Further, SI Group has evidently benefited from these imports since it is able to competitively price its downstream product in the export market.

23. In this connection the Authority notes that all issues raised by the opposing interested parties have been examined and in the factual matrix of the case it was found necessary to retain SI Group as a part of the domestic industry for injury examination in this case.

E. Interested Parties to this investigation

24. Apart from the petitioners the responding exporters and importers who have made themselves knows as interested parties in this investigation, as listed in para 5 (iv) and (vi) above, and the Governments of the responding countries have been treated as interested parties to this investigation.

F. Miscellaneous Submissions

F.1 Confidentiality

25. The opposing interested parties, in their submissions, have contended that petitioners have claimed excessive confidentiality. It has been argued that the domestic industry has not provided the basis for adjustments to export prices and Indexed ranges for costing information in Format A, B, C-1, C-2, D and E have not been provided and the underselling margin, capital employed and non-injurious price have not been disclosed in the petition in summarized form or in indexed ranges.

26. With regard to the confidentiality issues the domestic industry has submitted that all confidentiality claims of the domestic industry are as per the legal provisions, trade notice issued by the DGAD, and practice being followed by Authority in this regard. It has been further submitted that the questionnaire responses submitted by the interested parties are excessively confidential and prevent the domestic industry from making reasonable submissions.

27. The issues raised by the interested parties with regards to confidentiality have been examined. The Authority notes that to the extent possible and practicable the confidentiality claims of various parties submitting the information have been examined and confidentiality claims admitted on the basis of nature of information provided by the parties. As far as the submissions of the exporters are concerned, the information provided by the exporters, to the extent they are not business sensitive to the party providing the same, have been placed in the public file. In view of the above the objections of all parties with respect to confidentiality claims of the opposing parties have been disposed of.

F.2 Other Issues.

28. The opposing interested parties have further argued that the Petition for sunset review filed by the Petitioners is deficient to the extent that it does not adequately address likelihood and provides baseless allegations without any evidence to corroborate its claims. In fact, as regards the claim of likelihood, the Petitioners appear to be contradicting themselves. The Petitioners have claimed in the petition that the performance of the domestic industry shows no improvement. In the same paragraph, the Petitioners have then stated that there is no injury to the domestic industry because dumping has continued at low level. Such ambiguous statements are meant to mislead the interested parties and the Designated Authority. Therefore, the petition should be rejected.

29. Further the Petitioners have out rightly contradicted themselves on their own Petition as far as imports of the subject goods from Japan. The data indicates that there has been no import of the subject goods from Japan in the period of investigation and the previous year.

30. It has been submitted that Authority has, in several investigations, examined such a factual scenario, wherein there were no present imports from the subject countries in the recent years and revoked the duties in such cases. Therefore, given the fact that: (i) there are no imports of Acetone from Japan; (ii) there is sharp decline in imports of Acetone from Thailand and (iii) SI Group being major importer of Acetone during POI, there is no reason for continuing the anti-dumping duty in force on imports of the subject goods.

31. The exporters, in their submissions have also argued that the petitioners are inherently inefficient and have caused injury to themselves due to their operational infirmities and setbacks and resorting to repeatedly reliance on antidumping measures for over a decade. It has been argued that since its inception of its plant in 1987, HOCL has failed to make any improvement in its production facility or process even though the demand in the country has increased by nearly 200% since 1999. Since 2005 HOCL has been classified as a sick company and recently due to fall in international prices of crude Phenol manufacturing plant of HOCL has been shut down and HOCL has publicly admitted that these shutdowns are as a result of raw materials shortages which have no co-relation with the alleged dumping of the subject goods. Further, severe shortage of the working capital has also led to stoppage of production.

32. The domestic industry in its submissions has argued that the significance and purpose of imposition of anti-dumping duties is that the domestic industry gets increased fair market opportunities to sell its materials at fair prices. The domestic industry in the present case did not get fair market opportunity with the imposition of anti-dumping duty. However, cessation of anti-dumping duty would result in continuation or recurrence of duty and consequent injury to the domestic industry.

33. In their post disclosure submissions, the opposing interested parties have submitted that the merits of the present investigation can be adequately analysed only if due consideration is given to the history of the AD duties. The Authority has taken a due note of this fact in the disclosure statement. It has been argued that Anti- Dumping duties have been repeatedly relied on by the domestic industry for over a decade to buffer its own inefficiency and have attempted to systematically eliminate all competition from the domestic market.

34. The Authority notes that this product has a long history of anti-dumping investigations and duties have been imposed on the import of the subject goods from various countries since 2002. Apart from the subject countries, the duties are currently in force against imports from Chinese Taipei, USA, EU, Korea RP, South Africa, Saudi Arabia and Singapore.

35. With regard to the arguments of the interested parties that the petitioners are seeking repeated protection of antidumping duty while they are inherently inefficient, the Authority notes that in a sunset review investigation it is the consistent practice of the authority to review all the aspects of the original investigation, including the likelihood scenario of dumping and injury in the even to cessation of duties. Accordingly, all issues raised by the interested parties have been duly examined to the extent they are relevant and supported by evidence.

36. All other issues raised by the interested parties with regard to dumping and injury have been addressed in the respective sections in this finding to the extent they are relevant and supported by evidence.

G. Methodology of Determination of current Dumping

G.1 Legal Positions

37. Section 9A (5) of Customs Tariff Act, 1975 provides that: ‐ “The anti-dumping duty imposed under this Section shall, unless revoked earlier, cease to have effect on the expiry of five years from the date of such imposition:

Provided that if the Central Government, in a review, is of the opinion that the cessation of such duty is likely to lead to continuation or recurrence of dumping and injury, it may, from time to time, extend the period of such imposition for a further period of five years and such further period shall commence from the date of order of such extension;

Provided further that where a review initiated before the expiry of the aforesaid period of five years has not come to a conclusion before such expiry, the Anti-dumping duty may continue to remain in force pending the outcome of such a review for a further period not exceeding one year.”

38. Accordingly, in a sunset review investigation the Authority is required to examine:

Whether the dumping continues after imposition of the antidumping duty and if so, whether it is likely to continue;

In cases where dumping did not continue, whether the dumping would recur in the event of revocation of anti-dumping duties;

Whether the domestic industry continued to suffer material injury and if so, whether injury to the domestic industry is likely to continue if the duties are removed;

In cases where the domestic industry has not suffered continued injury, whether injury to the domestic industry is likely to recur in the event of revocation of anti-dumping duties.

39. Therefore, the Authority has first proceeded with the examination as to whether dumping of the subject goods continues from the subject countries and whether dumping is likely to continue or recur if the duties are revoked, before examining whether the domestic industry continues to suffer material injury on account of such dumped imports and injury is likely to continue or recur in such a situation.

G.2. Examination of Continuation of Dumping: Determination of Normal Values, Export Prices and Dumping Margins

40. The Authority notes that the following producers and exporters from Thailand and Japan have submitted their questionnaire responses:

1. M/s PTT Phenol Company Limited, Thailand (Producer)

2. M/s MITSUI & CO., LTD., JAPAN, (Exporter)

3. M/s MITSUI & CO. (ASIA PACIFIC) PTE. LTD., Singapore (Exporter)

41. The current dumping and likelihood of continuation or recurrence of dumping of the subject goods from these two countries have been examined based on the information filed by the cooperating exporters and other information provided by the domestic industry as follows:

Thailand

42. As per DGCI&S import data relied upon 3880 MT of Acetone was imported from Thailand during the POI. M/s PTT Phenol Company Limited, Thailand (PPCL), one of the major producers of the subject goods in Thailand has filed its questionnaire response in this case. As per the verified data of this exporter they had exported [***] MTs of the subject goods to India during this period. The difference is apparently because of one transaction of previous period being cleared in the POI.

43. During the POI PPCL exported the subject goods to India directly to unrelated customers in India. The responses filed have been verified through on-spot investigations. Accordingly, the normal value, export price and dumping margin have been determined based on the verified data of the producing exporter as follows:

Normal Value

44. During the POI PPCL sold [***] KG of the subject goods in the domestic market. However, only [***] KG was produced and sold against [***] transactions while the balance was traded sales. The domestic sales are against contracts signed with the regular buyers and the prices are determined by formula linked to ICIS LOR South East Asia Price. During the POI PPCL sold the subject goods in the domestic market to unaffiliated customers. Domestic supplies are ex-tank or delivered with various credit/payment terms. The Company provided details of these expenses for adjustment to domestic sales prices.

45. It was noted that though the domestic sales were throughout the POI the export sales were only in certain months in the POI. Due to significant fluctuation in prices of basic raw materials, i.e. benzene and propylene, in the global market the producer has requested for determination of normal values and export prices on monthly basis and has provided month wise cost sheet of Acetone. Accordingly, the month wise domestic sales were subjected to ordinary course of trade test and the monthly normal values have been determined as follows after adjusting the domestic sales prices for expenses towards Inland Freight, Handling expenses and Credit Cost wherever applicable as given in the dumping margin table below.

Export Price

46. During the POI PPCL exported [***] KG of the subject goods directly to independent buyer in India. All sales were on FOB term and with 90 day’s credit. The producing exporter has provided information on expenses towards handling expenses, which included storage cost, throughput cost, shipping cost and surveyor fee, and credit expenses which were verified.

47. Acetone is first delivered to Thai Tank Terminal for distribution, both for domestic and export in bulk. The Company pays a fixed fee and throughput fee to Thai Tank Terminal. Accordingly, PPCL has claimed handling expenses, which are comprised of storage and throughput expenditure. The net ex-works export prices of the company for its exports have been determined after due adjustments towards Inland freight, ocean freight, handling expenses, credit cost, bank charges, wherever applicable. The exports are in bulk form and no packing expenses are involved.

Accordingly, month-wise net ex-works export prices work out as given in the dumping margin table below.

Dumping margin

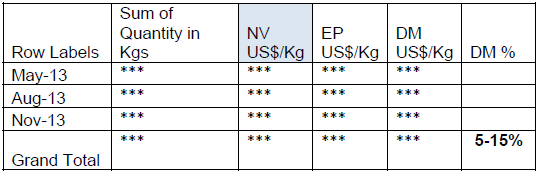

48. The month-wise normal value determined at ex-works level have been compared with the month-wise export price to arrive at the dumping margin for PPCL as follows:

All other exporters from Thailand

49. There is no other producer of the subject goods in Thailand. Therefore, determination of residual dumping margin for other producers and exporters in Thailand is infructuous and therefore, has not been carried out.

Japan

50. The DGCI&S data relied upon indicates that no imports of the subject goods has taken place from Japan during the POI. No questionnaire response has been filed by any producer of the subject goods in Japan. Therefore, no determination of dumping margin has been made in respect of Japan.

51. The above examination indicates that the dumping margin of the subject goods imported from Thailand during the POI was above de minimis level and there was no dumping from Japan during the said period.

H. Likelihood of continuation or recurrence of dumping

H.1 Views of the opposing interested parties

52. The opposing interested parties, in their submissions have argued that

i. Petitioners have calculated some vague and unsubstantiated dumping margins.

ii. Petitioners have not only not provided any evidence to substantiate export orientation; they have failed to give the source of third country data and evidence in this regard.

iii. The argument of price attractiveness is contradictory because the petitioner’s data suggests that the present export price to India does not allow for recovery of cost. Petitioner’s argument contradicts the concept of producer’s equilibrium. They are posing selling below cost to be ‘attractive’.

iv. Price undercutting has remained constant in the POI yet the extent of injury and profitability has seen radical variation implying that price undercutting has no correlation to the injury suffered by the domestic industry.

H.2 Views of the domestic industry

53. The domestic industry, in its submissions has argued

i. That dumping has continued in case of Thailand. The volume of imports is significant enough in case of Thailand to allow a determination with regard to likelihood in the event of cessation of anti-dumping duty.

ii. That in case of Japan, although there have been no imports during the present POI, the presence of, significant exports to third countries at dumped prices clearly shows likelihood of dumping and injury. Thus the dumping is likely to recur in case of cessation of anti-dumping duty.

iii. That there are significant exports from Japan to third countries revealing a significant injury margin. There is significant dumping in the third countries from Thailand as well. Therefore, in the event of cessation of the antidumping duties, there is strong likelihood of these third country imports getting dumped in India.

iv. That Dumping Margin determined in previous investigations and present petition are significant and clearly shows likelihood of dumping and consequent injury in the event of cessation of anti-dumping duty.

v. That the prices at which subject goods are being imported are substantially lower than the price at which the goods are being sold in the domestic market.

vi. That there is significant price undercutting which is likely to intensify if the duties are revoked. Significant price undercutting by the Japanese exports is likely, considering the prices at which the Japanese exporters have exported the product under consideration to third countries in the POI.

vii. That there is no contradiction in domestic industry’s statements with regard to likelihood. Dumping of the product under consideration, injury to the domestic industry, injury to the domestic industry from present subject countries, injury to the domestic industry from other dumping sources, injury to the domestic industry from present subject countries in the event of cessation of anti dumping duty are all different parameters and must be considered accordingly.

viii. That excess capacity is a proved parameter to determine likelihood, it is sufficient to show high probability of injury to domestic industry.

ix. That excess capacity in a country can lead to many problems in the home country such as falling product prices, deteriorating profitability, corporate – sector distress and financial sector distress which can cause the producer to look for avenues outside the country at disposable prices. The purchasing power of the citizens may not grow at the same rate. In such situations since the demand is already excessive, the investments are controlled because in such a scenario investments result in loss rather than profit. A glut of capacity is an important indicator of likelihood analysis in anti-dumping investigations.

x. That it is not necessary that the price undercutting increases with increase in losses. The two are different parameters.

H.3 Examination by the Authority

54. It was noted in the previous section that there were no dumped imports from Japan during the POI. The imports from Thailand was at dumped prices. In view of the above what is required to be examined in this review is whether the dumping would continue from Thailand or recur from Japan if the duties are revoked. In this connection the Authority has looked at the price behavior and capacities of the major producers in the subject countries.

55. As far as Thailand is concerned, PPCL is the only major producer of Acetone in Thailand with a maximum capacity of about [***] KT per annum which they operate at above 100% capacity utilization. It has been submitted by the Company that the consumption of Acetone in Thailand is mainly for BPA and MMA production and annual demand is approximately 160,000 MTs. Since they have started their own Bis-Phenol A (BPA) production since 2010, their export of Acetone has substantially reduced. Export quantity has further reduced after they started MMA production in 2013. The data submitted by PPCL indicates that their domestic sales and captive consumption constitutes about ***% of their annual productions on annualized basis over the injury investigation period. The exports, which accounted for about ***% of production, has come down to about *** % in the POI indicating increased domestic consumption of the goods.

56. PPCL, in its response has indicated that they are considering to augment their capacity in the near future to double phenol capacity for the purpose of fulfilling major demand from domestic market and third countries. The Acetone capacity will also be increased in that proportion. The Company has indicated that the capacity is being augmented to cater to the demands from the domestic and third country customers. Therefore, while export orientation of the Company has been gradually diminishing with increased domestic consumption it appears that PPCL will still have significant export of the subject goods to various countries in the near future.

57. The Price trend of PPCL during the period of investigation indicates that the prices in the domestic market, and third countries were in a narrow band. The export prices at gross level are marginally higher than the domestic prices. Though the gross level prices may not clearly indicate the actual level of dumping, it would not be significantly high. Hence the arguments of the domestic industry that the third country exports from Thailand are at dumped prices and therefore, there is a likelihood of intensified dumping to India, if duties are revoked, do not seem to be supported by these facts. In this connection the post POI (Oct 2014-March 2015) data has also been examined and the data shows that there has not been any significant increase in volume of imports of Acetone from Thailand despite the fact that HOCL has gone completely out of production and the additional gap of about 20,000 MT has to be filled up through increased imports. On the price front the prices from across the countries show significant drop from the first quarter of 2015 apparently because of crude price situation. Therefore, it appears that the imports from Thailand would continue at the current level even if the duties are removed. Since the prices from Thailand is following the global trend, major reduction of prices by this producer vis a vis other global producers do not appear to be imminent.

58. As regards Japan, there is no import of Acetone from that country during the POI and also during the post POI period. During the injury investigation period there was significant import in 2011-12 and 2012-13. No response has been received from any producer in Japan. However, Mitsui & Co. a major exporter of the subject goods in Japan has filed a questionnaire response in which it has provided the production and domestic consumption data in Japan. As per this data Japan’s total production of Acetone is about 375KTs, down from 500 KTs in 2013, apparently because of closer of joint venture plant Mitsui Chemicals with Idemitsu at Kosan in September 2014. As per the above data the demand in the country, which was significantly below the production, would match up with the domestic production, indicating no significant excess production in the country.

59. The price level indicated by Mitsui & Co shows that at gross level domestic prices and prices to the third countries are in a narrow band. The Company has not exported the subject goods of Japan origin to India during the POI. There is no import from Japan in the post POI period either.

60. ICIS report on the demand supply scenario in Asia indicates that outside China, strained margins prompted producers in Asia region to scale back their phenol/acetone output in 2015. Demand growth for acetone is expected to again lag the supply gain in 2016. In the downstream sectors, there is limited expansion in Bisphenol A (BPA) and Methyl Methacrylate (MMA) capacities. The only notable BPA capacity increase in 2016 is the 110,000 tonne/year BPA expansion planned by Covestro at its Shanghai site. That will boost acetone consumption by 30,000 tonnes/year. Three new MMA plants, with a combined MMA capacity of 175,000 tonnes, are scheduled to start up in China in 2016, according to data compiled by ICIS China. At full operating rates, these are expected to consume 122,500 tonnes/year of acetone. In the first quarter of 2016, Jiangsu Sailboat Petrochemical is expected to commission its new 100,000 tonne/year MMA plant while Shandong Hongxu Chemical will complete the expansion of its MMA capacity by 25,000 tonne/year, according to data compiled by ICIS China. Construction of Dongming Huayi New Materials’s new 50,000 tonne/year MMA plant is under way and the plant is due to start up in late 2016. As per the ICIS report, deepening slowdown in Asia’s largest economy is also likely to sap demand for acetone in the solvents sector, the biggest downstream segment accounting for 40-50% of acetone consumption in China. Fresh signs of further economic weaknesses in China – as evidenced by the most recent manufacturing and producer price data – indicates limited prospect for acetone demand growth. The report also indicates a significant drop in prices of Acetone, post Oct 2015, because of weak demand in China.

61. The overall assessment of demand supply and price scenario in Asia region indicates there could be some export of Acetone to India from Japan and Thailand if the duties are removed and the imports may follow the price trend as indicated in the ICIS report. Therefore, likelihood of continuation of dumping from Thailand and recurrence of dumping from Japan cannot be ruled out.

I. Methodology and Determination of Injury and Causal Link

62. As noted earlier, in a sunset review investigation, with regard to injury examination, the Authority is required to examine:

Whether the domestic industry continued to suffer injury and if so, whether injury to the domestic industry is likely to continue;

In cases where the domestic industry has not suffered continued injury, whether injury to the domestic industry is likely to recur in the event of revocation of antidumping duties.

63. Therefore, the Authority has first examined whether the domestic industry continues to suffer material injury on account of dumped imports from the subject countries before proceeding to examine the likelihood of continuation or recurrence of injury to the domestic industry in the event of revocation of the duties from the subject countries. Examination of material injury to the domestic industry is in accordance with the Article 3 of the AD Agreement and Annexure II to the AD Rules, 1995.

J. Determination of Injury and Causal Link

J.1 Submissions of the opposing interested parties

64. The opposing interested parties have made the following submissions with regard to the injury and causal link:

i. There is a contradiction in the petitioners’ submissions that domestic industry performance shows no improvement and at the same time domestic industry claims that this is a case where dumping has continued at low level and the domestic industry has not suffered injury because of low level of dumping but injury to the domestic industry i.e. likely in case the present anti-dumping duties are withdrawn.

ii. That as per market intelligence it is known that a large portion of the imports of the subject goods have been made in the injury period as well as the period of investigation under the advance license scheme. Under the said scheme, any domestic producers seeking to export his finished products may import their raw materials under the said advance license. The advantage of such a scheme would be that any imports made under advance license are exempted from any anti-dumping or safeguard duties. SI Group, one of the applicants in this case, has imported significant quantities of the subject goods under advance licence. Therefore, DA must segregate and analyze SI Group imports into duty paid and duty free imports and the same should be made available to the interested parties;

iii. Citing the judgment in Vetcare Organic Pvt. Ltd. vs CESTAT, Chennai, 2011 (269) E.L.T. 444 (Mad.), and Thai Acrylic Fibre Co. Ltd. vs. Designated Authority, 2010 (253) E.L.T. 564 (Tri. - Del.), the opposing interested parties have argued that imports under advance license ought to be identified and excluded from the import volumes considered for examining injury and dumping.

iv. That any injury suffered by HOCL is inflicted by its own inefficiencies, operational infirmities and other setbacks and has been seeking protection of antidumping law for over a decade now which is evident from the plethora of investigation since 2002.

v. That in a Safeguard investigation in 1999 HOCL submitted an adjustment plan in lieu of the safeguards duty in which they gave some exaggerated plans to expand capacity and minimise cost as they admitted then that one of the reasons identified by them is the lack of economies of scales. Despite that admitted fact and adjustment plans HOCL’s capacity remains at the same exact level as it was in 1999.

vi. That in the present petition HOCL has admitted that the long shutdowns are a result of raw material shortages, and other issues which have no correlation to the alleged dumping of the subject goods. Despite several help from parent ministry and various anti-dumping duties HOCL was classified as a sick company by BIFR under SICA and has remained so for nearly a decade. Reliance has been placed on the Ninth Report of Parliamentary Committee on Public Undertakings (2015-16) which clearly records that even after 16 years having elapsed from its proposal submitted to Directorate General of Safeguards, HOCL has not upgraded the technology for manufacture of Cumene by the use of modern zeolite catalyst system.

vii. That this shows that there is indeed no injury due to the alleged dumping and the Petitioners are abusing the anti-dumping laws by misrepresenting before the Hon’ble Authority. Further, this reflects an inability to overcome HOCL’s inefficiency and a lack of initiative to expand and seize the expanding demand.

viii. That HOCL, has had repeated and sustained plant shutdowns in recent years, including the period of investigation. Since 2005, HOCL has been classified a sick company under the Indian law. Recently due to an international fall in crude prices, the Phenol manufacturing plant of HOCL was shut down again. These continuous shutdowns have impacted the ability of HOCL to supply to the domestic market and consequently HOCL’s performance has suffered. In fact HOCL has publically admitted that these shutdowns are as a result of raw material shortages, which has no correlation to the alleged dumping of the subject goods.

ix. That as admitted by HOCL, the Rasayani plant remains closed as of today and yet the Petitioners claim that their production and sales levels have been falling due to alleged dumping.

x. That a severe shortage of working capital has also led to stoppage in production. The Company is on record in public domain that Kochi Refinery, which was supplying the raw materials, has refused to continue the supply as the Company had a debt of over 90 crores. Therefore, reintroduction of the anti-dumping duty will hardly help them to bring the plant to operation.

xi. That there is a huge demand-supply gap in the country making imports inevitable.

xii. That the injury to the domestic industry is not due to imports but due to various other factors as highlighted in the Parliamentary Committee Report such as high cost of production, huge demand-supply gap, poor technology, plant inefficiencies, plant shutdowns, lack of foresight and poor management.

xiii. The production has suffered due to recurring and sustained plant shutdowns. The domestic industry has lost 22% market share while the subject countries imports have gained only 4% of the market share. The majority share is attributed to the imports from Korea and Singapore.

xiv.The performance of SI Group, the only other producer of the subject goods in India has been much better, indicating internal inefficiencies of HOCL causing loss of market share.

xv. That excess capacity of the exporters cannot be prejudiced against them. There is no proposition under any law or WTO that one must only produce what is required by it. The assumption that any excess capacity in the world will hit only India is faulty and hurts the consumers.

xvi.That there is breach in causal link as no injury has been suffered on account of subject imports. There is heavy impact of imports from Korea and other countries not including subject countries. HOCL has acknowledged that it is the withdrawal of anti-dumping duties on other countries and not the subject countries, since the duties on subject countries were never ever removed.

J.2 Submissions by the domestic industry

65. The domestic industry has made the following submissions with regard to the injury and causal link:

i. That the demand for the product under consideration has increased in the POI with respect to the base year.

ii. That the volume of imports from Thailand in the POI were much higher than the imports in the base year and is significant enough to establish dumping and injury for the purpose of deciding the likely situation.

iii. As regards Japan, while there were no imports in the present period, Japan has exported significant volumes to third countries, which shows significant price undercutting, dumping margin and injury margin in the event of cessation of anti-dumping duty and diversion of these goods to India. There is strong likelihood that volume of imports shall increase further if antidumping duties are removed.

iv. In case of Thailand the subject imports are undercutting the prices of like product in India. However, in case of Japan third country exports are at such prices that cessation of anti-dumping duty shall result in diversion of goods to the Indian market and the domestic industry would suffer price undercutting.

v. Imports are undercutting the domestic price and effect of cessation of antidumping duty shall have significant suppressing effect on the prices of the domestic industry in the market.

vi. While the current low volume of imports from Thailand and no imports from Japan was due to the anti-dumping duty in force and should the present antidumping duty be withdrawn, it is evident that the dumping would intensify and the imports from these countries shall cause injury to the domestic industry.

vii. Domestic industry has continued to suffer material injury due to continued dumping of the products in the country.

viii. The jurisprudence on the issue of advance licensing warrants that the import volume coming under advance licensing is causing a price injury. Therefore, it cannot be excluded.

ix. The imports of SI Group are duty free imports made against export obligation and therefore, are not a cause of concern for the present investigation.

x. There is no obligation on the Designated Authority to segregate and analyze SI Group imports into duty paid and duty free imports.

xi. Demand supply gap justifies imports per se but not dumping of the product in the country. As held by CESTAT in the matter of DSM Idemitsu, if the exporters wanted to supply the goods to meet the requirement in Indian market that could be done by exporting the requirements at a price equivalent to normal value but not at a dumped value and to capture the market.

xii. In past anti-dumping duties have only been imposed when the parameters are satisfied.

xiii. The claimed injury is not due to developments is technology. Further it is an established principle that domestic industry should be seen as it is and not in the context of ideal conditions.

xiv. Even if HOCL was classified as a sick industry an analysis must be done as to whether it was a sick company due to other reasons without attributing injury caused by other factors to dumping.

xv. Raw material shortages are a result of prolonged dumping and consequent injury. There is a direct causal link

xvi. Dumping leads to injury, leading to decline in profitability resulting in losses suffered by domestic industry, which impacts cash flow, which in turn affects the ability of the company to source raw materials. This leads to production suffering which adversely impacts the capacity utilization and sales. As a result, cost of production increases due to lower production and losses further impact the cash flow. The mounting cash flows impact the ability of company to source raw materials and this cycle continues so long as the market remains impacted by dumping.

xvii. With regard to SI Group interested parties have focused on difference in performance whereas the requirement under the law is deterioration (or likelihood of deterioration) in performance.

xviii. Injury to the domestic industry from other dumped imports does not imply "no injury or likelihood thereof" from present sources.

xix. That the interested parties referred to reviews/recommendations of the Parliamentary Committee on public undertaking at the time of oral hearing and read extensively about the contents of its report, projecting as if the Parliamentary Committee has actually found entirely different reasons for adverse performance of HOCL and that HOCL has wrongly attributed their difficulties to the dumping in their product.

xx. Despite anti-dumping duties in the past many years the domestic industry has been suffering from unfair competition from one source to another. This is primarily due to significant surplus in the global market and the ability of the global producers to dump the goods. The suspension of production by HOCL may turn to complete shut down if domestic industry is not meted out justified anti-dumping duties.

xxi. If there is any mismanagement at the end of HOCL then it is rightly being dealt with by the parliamentary committee since HOCL is a public sector undertaking. Further for the purposes of anti-dumping the Authority would only recommend duty after following requirements prescribed under the laws. Such a finding of the Committee in no way jeopardizes the investigation process of Designated Authority.

xxii. Contrary to the averment of the opposing interested parties the Committee recognized the ‘negative’ impact of the withdrawal of anti-dumping duty as one of the significant factors leading to dismal situation of HOCL.

xxiii. That dumping has not just impacted HOCL, SI Group has also suffered. The Designated Authority may kindly examine the injury statements of the two companies.

J.3. Post disclosure submissions of the interested parties

66. In its post disclosure submissions, the domestic industry, has mostly reiterated its stand on the injury and causal link and had inter alia submitted as follows:

i. That the Price Undercutting is positive and is likely to increase the demand for the product under consideration in the market in the event of cessation of anti-dumping duty.

ii. That HOCL suspended production because of intensified dumping of the product which has made its current operations totally unviable. HOCL has not completely gone out of business. It has merely suspended production. Which has been recommenced and a certificate as asked by the Authority was also provided

iii. That performance of the domestic industry in terms of production, capacity utilization, domestic sales, market share, profits, return on investments, cash flow has deteriorated. The information filed by SI Group clearly shows significant deterioration in its profits, cash flows and return on investment. While SI Group is a private enterprise, HOCL is a public sector organization. The financial losses being suffered by the company forced the company to reduce its production.

iv. That sales realization has been below cost of production in the period of investigation.

v. That because of dumping of the global surplus of the product in the Indian market, HOCL could not improve its performance further and is once again suffering losses.

vi. That the domestic industry is still suffering continued injury from the imports of dumped subject goods;

vii. That even at best capacity utilization, HOCL would have suffered significant adverse price effect in the POI.

viii. That none of the factors such as exchange volatility, inflation, high interest rates, and volatile stock markets are responsible for claimed injury to the domestic industry. There has been no significant change on any of these factors and as far as domestic industry and the present product is concerned. The performance of the domestic industry has, however, significantly deteriorated which clearly establishes that such deterioration is not because of the other factors.

ix. That imports from Thailand are significant, which clearly shows that the Thailand producers are likely to cause significant injury to the domestic industry in case of cessation of anti-dumping duty.

x. That HOCL has not adopted different methodology to allocate cost to Phenol and Acetone. HOCL has provided information in a consistent manner.

xi. That relevant parameters show that injury to the domestic industry has been caused by the dumped imports and thereby establish causal link.

xii. That contraction in demand is not a possible reason, which could have contributed to injury to the domestic industry.

xiii. That pattern of consumption with regard to the product under consideration has not undergone any change. Change in pattern of consumption is unlikely to contribute to the injury to the domestic industry.

xiv. That there is no trade restrictive practice, which could have contributed to the injury to the domestic industry.

xv. That technology for production of the product has not undergone any change nor are there any likely changes in coming future. Developments in technology are therefore, not a factor of injury.

xvi. That the fact of dumping is established by the Authority in all past cases. The significant global surplus in Phenol and Acetone capacity is clearly the cause of dumping of the product in India. Such significant surpluses are likely to continue. In fact, demand for Phenol is likely to increase without proportionate increase in demand of Acetone, which will further create pressure on Acetone prices in the global market.

67. The opposing interested parties, in their post disclosure submissions, have argued as under:

That if import volumes (or prices) prevalent in advance license imports are injuring a domestic industry, any levy of anti-dumping duties will not remedy such an injury. Unless there is a wide policy change, no levy of anti-dumping duties will be able to protect the Petitioners from advance license imports (whether dumped or not).

That imports might have been triggered due to the suspension of production by the domestic industry during the POI. Inflow of imports into India does not point towards dumping especially in the present case where the domestic industry has suspended production during the POI – in fact such competition is merely an indicator of a free market. Furthermore, as noted by the Authority at paragraph 71 of the Phenol disclosure statement, the major gain had been for the other non-subject countries attracting duties, and not subject countries. This aspect clearly indicates that there was no volume injury from the subject countries.

That the net sales realisation of the Domestic Industry still remains above the non-injurious price in spite of the fact that the cost and prices were affected due to suspension of the production by HOCL for a major part of the POI. This statement clearly indicates that there is a clear breach in causal link between imports from subject countries and the alleged injury claimed by the Domestic Industry as the alleged dumped imports do not seem to restrict the Domestic Industry to recover its Non Injurious Price from the Indian market. Owing to this finding alone, the Authority should return a final finding recommending discontinuation of duties from the subject countries.

That SI Group was in full production during the POI and was able to sell at a relatively higher price in the same market during the same period, much above the landed prices, which indicates that the dumped imports did not have suppression or depression effect on the domestic prices.

That the HOCL shutdown was because of internal factors such as lack of modernization of technology, working capital crunch and non-supply of raw materials by the refinery due to mounting dues from HOCL and not because of alleged dumping from the subject countries.

J.4 Examination by the Authority

68. The Authority has taken note of various submissions of the interested parties and the domestic industry on the injury and causal links and all the averments made have been examined taking into account the facts available on record and applicable law. Accordingly, the Authority proceeds to examine the current injury, if any, to the domestic industry before proceeding to examine the likelihood of continuation or recurrence injury on account of imports from the subject countries in the event of cessation of the duties.

69. Rule 11 of Antidumping Rules read with Annexure–II provides that an injury determination shall involve examination of factors that may indicate injury to the domestic industry, “…. taking into account all relevant facts, including the volume of dumped imports, their effect on prices in the domestic market for like articles and the consequent effect of such imports on domestic producers of such articles….” In considering the effect of the dumped imports on prices, it is considered necessary to examine whether there has been a significant price undercutting by the dumped imports as compared with the price of the like article in India, or whether the effect of such imports is otherwise to depress prices to a significant degree or prevent price increases, which otherwise would have occurred, to a significant degree.

70. For the purpose of current injury analysis, the Authority is required to examine the volume and price effects of dumped imports of the subject goods from the subject countries on the domestic industry and its effect on the prices and profitability, to examine the existence of injury and causal links between the dumping and injury, if any.

71. The Authority notes that the application for continuation of antidumping duty was initially filed by HOCL and SI Industries and they have been treated as the domestic industry for the purpose of injury investigation in this review. However, as argued by the domestic industry performance of both the producers has also been examined separately, to the extent feasible, to see the state of health of both the domestic producers as HOCL was out of production for a considerable period during the POI thereby significantly affecting their performance indices.

72. The volume and price impacts of the dumped imports on the physical parameters of the domestic industry have been examined before proceeding to examine the likelihood of continuation or recurrence of injury to the domestic industry in the event of revocation of the duties.

A. Volume impact of dumped imports

(i) Import Volumes & share in Imports

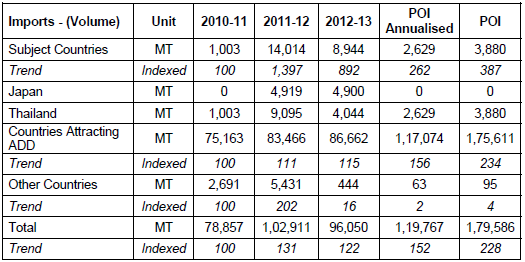

73. The import data obtained from DGCI&S has been examined to analyse the trend in import volumes and prices and their impact on the domestic industry as follows:

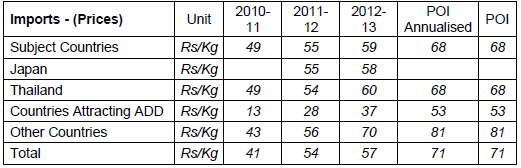

74. The data above shows that total imports during the injury investigation period grew almost by about 52% on annualised basis compared to the base year. However, while there is no import from Japan during major part of the injury period, including POI, imports from Thailand has increased significantly during this period by about 162% on annualised basis. But the imports from Thailand accounts for only about 2.2% of total imports. The Authority notes that though the subject goods are attracting antidumping duty on imports from several countries, imports from these countries have significantly increased during this period and account for about 97.75% of total imports, whereas imports from other countries are negligible.

75. The interested parties have argued that a significant volume of imports are under advance licence scheme without payment of the antidumping duties and therefore, the imports should be segregated and analysed for the injury analysis. However, none of the interested parties has provided any information on the volume of imports under advance licence.

ii) Assessment of Demand and Market Shares

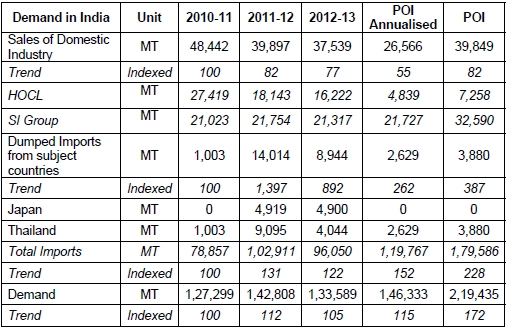

76. The interested parties have argued that there is a huge demand supply gap in the domestic market. The demand data determined as the sum of domestic sales of the Indian producers and imports from all sources is as follows:

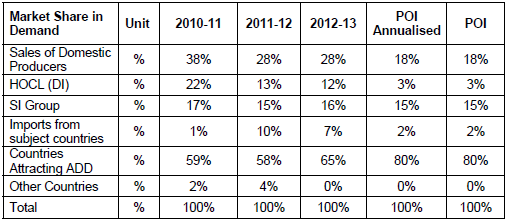

77. The above data indicates that while demand has remained flat the imports have increased and domestic sales have declined significantly, particularly during the POI, largely because of decline in HOCL’s sales. The trend in market share of various players in the domestic market during the POI was as follows:

78. The above data indicates that the share of the domestic producers in the total demand has fallen largely due to production loss of HOCL as the other producer is producing at almost its full capacity and maintains its market share. The share of imports from Thailand has declined after increase in 2011-12 and 2012-13. But major gain has been for the other countries attracting duties, which corner about 80% of the market demand in the country.

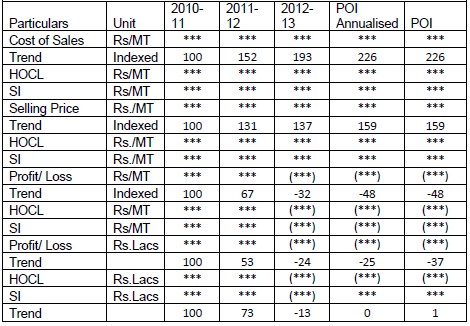

B. Price impact of dumped imports

i) Trend of Import Prices

79. The import prices of the subject goods imported from various countries during the POI as per DGCI&S data is as follows:

80. The data above indicates that the CIF prices of imports from the subject countries are significantly high compared to other countries attracting duties. Import from other countries are insignificant in volume.

ii) Price undercutting effect of dumped imports

81. To examine the price undercutting effects of the dumped imports from the subject countries the landed values of the imports have been compared with the net sales realisations of the domestic industry.

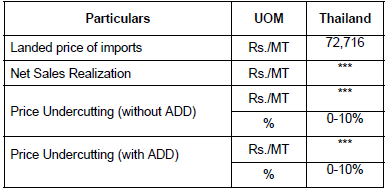

82. The data indicates that the dumped imports from Thailand undercut the selling prices of the domestic industry.

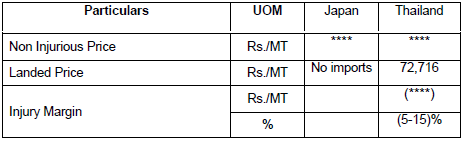

Price underselling effects of dumped imports

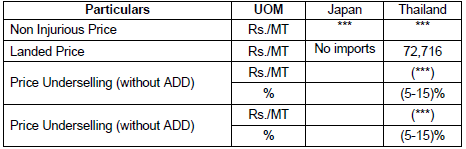

83. The landed value of the dumped imports has also been compared with the Noninjurious price determined for the domestic industry to see if the dumped imports had significant price underselling effect on the domestic prices.

84. The above data indicates that the dumped imports did not have any underselling effect on the domestic industry’s prices during the POI as the antidumping duty paid landed value of imports from the subject countries was above the non-injurious price of the domestic industry.

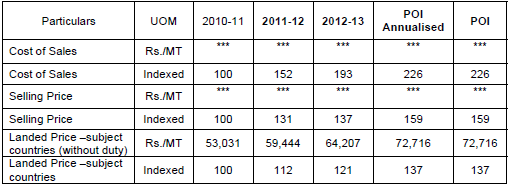

iii) Price suppression or depression

85. Since the cost of the domestic industry has been significantly affected by production loss and very low capacity utilisation during the POI, a reasonable analysis of the trends to see if the price of the domestic industry has been considerably suppressed because of the presence of dumped imports, is not possible. However, the trend of cost of sales, selling price and landed values of imports during the injury period are as follows:

86. It is noted that the cost of the domestic industry has been significantly affected since 2012-13 because of significant drop in production of HOCL. However, trend of selling price has been higher than the landed values of imports from the subject countries. Therefore, it cannot be held that the prices are suppressed or depressed to any significant extent.

(i) Actual and potential impact on Capacity, Production, Capacity Utilization and Sales