63 Moons Tech's arm signs pact to sell stake in Bourse Africa

The Dollar Business Bureau 63 Moons Technologies, previously Financial Technologies (India) Ltd, said on Thursday that its subsidiary based in Mauritius has inked a revised pact with the Continental Africa Holdings (CAHL) to sell its complete share in Bourse Africa Ltd for $10.50 million.“Our subsidiary FT Group Investments Pvt Ltd (FTGIPL) Mauritius has entered into an amended SPA (Share Purchase Agreement) with CAHL for sale of its 100 percent stake in Bourse Africa Ltd (BAL), Mauritius for $10.50 million,” the company said in a BSE filing.The revised SPA is being subjected to some specific approvals in India and Mauritius, and also to some specific conditions precedent that includes seeking of direction from the National Company Law Tribunal (NCLT) and other regulatory bodies, it said.It has to be noted that the ...

NCML opens 4,000-MT capacity cold storage unit in Guntur, AP

The Dollar Business Bureau Agri-logistics firm NCML has launched the state-of-the-art Cold Storage facility in Guntur, Andhra Pradesh on Thursday. The 4,000-MT capacity warehouse has been constructed at a cost of Rs.9.45 crore. It can hold approximately one lakh bags, weighing around 40 kg each. The facility was inaugurated by former IAS officer and MD & CEO of the company Sanjay Kaul along with the Deputy CEO Unupom Kausik and others. Sanjay Kaul said that the warehouse facility has been constructed to extend benefit to the chilli farmers of AP. This provides a platform for scientific storage practices to store their produce at the best quality standards. The facility is established in Guntur to create a healthy market environment for the chilli farmers to ...

RBI should allow rupee depreciation to help exports

The Dollar Business Bureau Indian exports can be more competitive if the Reserve Bank of India allows the currency to depreciate, an industry body has said, and suggested the central bank to use its forex reserves in defence only in a rout situation. “Any depreciation in rupee on account of China-led turmoil in the global financial markets should only be a welcome sign for India, else Indian exports will suffer more at the hands of China and other emerging countries witnessing correction in their currencies,” said Associated Chamber of Commerce and Industry(ASSOCHAM) in its report 'Implications of Devaluation of Chinese Yuan’. Stating that China is a major challenge for India’s export competitiveness in the global market, the report pointed out that ...

Winter is coming. Or, has it already?

Manish K. Pandey | The Dollar Business It was September 15, 2008. Financial services behemoth Lehman Brothers, holding over $600 billion in assets, filed for Chapter 11 bankruptcy (the filing remains the largest bankruptcy filing in US history till date). And the financial world came to a standstill. After all, it was the first big casualty of the US housing crisis that abruptly halted a nearly threedecade- long expansion of global financial markets [from 1980 through 2007, the world’s financial assets nearly quadrupled in size relative to global GDP; as per Mckinsey Global Institute]. Not only did the total value of global assets fall by $16 trillion, the deluge also washed away the dreams and hopes of millions of investors around the world. In fact, falling equities accounted for ...

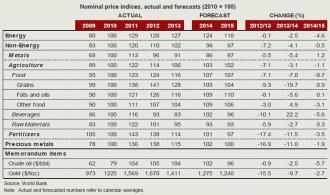

Commodity export earnings forecast to dip due to low prices: World Bank

Bidhu Bhushan Palo | @TheDollarBiz Exporters of commodities are likely to face sluggish growth and low returns in the remaining months of 2014 and most of 2015 due to surplus stocks and uneven economic growth in Europe and emerging economies, the World Bank (WB) says in its October 2014 Commodity Markets Outlook. There are multiple factors behind the weakening of commodity prices in Q3 2014, including a growing concern over a slowdown in the Euro Area and emerging economies, a resurgent US dollar, surplus oil production and good prospects for most crops. Prices of a majority of “most primary commodities” (energy, metals, agriculture, precious metals and fertiliser), particularly oil and gold, are expected to remain weak in Q4 2014 and through ...