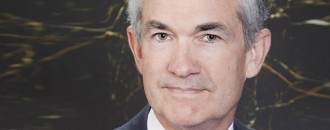

Jerome Powell to take over Janet Yellen as Feds chairman

The Dollar Business Bureau Jerome Powell will succeed Janet Yellen as the next chairman of the US’ Federal Reserve Bank - the most powerful central bank in the world. The selection of Powell has been confirmed by the US Senate with 84-13 vote with support from both Republicans as well as many Democrats. Powell, a 64-year-old lawyer, was nominated by President Donald Trump in November last year. He has served on the Federal Reserve’s board since 2012, and would take over when Yellen’s term expires on February 3, 2018. Yellen, the present chairman of Federal Reserve, was selected in 2014 by President Barack Obama and has been the first woman to be appointed on the position. Powell was seen as a safe choice by ...

Global economic growth to boost US exports: Janet Yellen

The Dollar Business Bureau Estimating a positive economic prospect for the US, Janet L Yellen, Chairwoman, Federal Reserve System Board has told the American lawmakers that the world growth is likely to boost the US exports. “I expect that, with further gradual adjustments in the stance of monetary policy, the economy will continue to expand at a moderate pace over the next couple of years, with the job market strengthening somewhat further and inflation rising to 2%,” she told House Finance Services Committee members during a Congressional hearing. “This judgement shows our view that the monetary policy continue to be accommodative. The present job gains would continue supporting the growth in incomes, thereby consumer spending. The world economic growth should further support US ...

Industry reiterates its demand for a rate cut by RBI as IIP slips to 3.1%

The Dollar Business Bureau As growth of country’s industrial production slipped to 3.1% in the month of April, India Inc reiterated its demand for a cut in interest rate by the Reserve Bank of India (RBI), stating that it was imperative to bolster growth as well as consumer demand. Industry body ASSOCHAM said on Monday that the industry has been disappointed by the RBI’s status quo on the interest rates as there was a possibility for a cut in the key policy rate. “It is unfortunate for the industry that while the government has taken steps to revive the demand by implementing reforms, RBI's stance to maintain the status quo has hit the expectations of the industry though there was a room for ...

UN downgrades Indias GDP growth forecast to 7.3% in 2017

The Dollar Business Bureau The United Nations (UN) has revised India’s GDP growth forecast downward for 2017 but projected an increase in 2018 predicting 7.9% economic growth as it warned that the banking sectors’ stressed balance sheets will have adverse impact on investments in the short-term. The UN World Economic Situation and Prospects (UNWESP) in its mid-2017 report, launched on Tuesday, said that India is predicted to achieve a growth of 7.3% this year, downward from its earlier forecast of 7.7%, which it made when the report was launched in January. However, the revised report forecast that the country will achieve a notable 7.9% GDP growth next year, from its earlier estimates of 7.6% made in the January report. The report, however, cautioned that stressed balance sheets of India’s banking sector, which has ...

The week that was: oil, sugar and core sector growth

By Abin Daya It is very rare that you will find a month in which all the 8 core sector industries have had positive growth. No, it did not happen in Feb 2017; but it happened a year back – in Feb 2016! Before that it happened in 2010 – that too, three months in a row! In the case of Feb 2016, what made the month even more special was that 4 out of 8 core sector industries grew in double digits! Understandably, when something like that happens, you expect a significantly high rate of growth for the sector. Core sector grew at 9.4% in Feb 2016. Compare that with the core sector performance a year later, in Feb 2017. Such a ...

ECB goes for new stimulus push to meet inflation goal

The Dollar Business Bureau European Central Bank’s (ECB) President Mario Draghi warned that the fresh stimulus push by the Bank might not be the final one as it strives to meet its inflation goal. “The monetary-policy decisions’ intention is to retain the high degree of accommodation in place,” Draghi told reporters in Frankfurt after the meeting of Governing Council, which agreed to add $576 billion (540 billion euros) to its programme of bond-buying and extend this until the next year-end. If “the outlook becomes less favourable or financial conditions become inconsistent with further inflation progress, the governing council intends to increase the programme in size or duration,” he added. The newest action of ECB comes amidst concerns that the gradual economic recovery risks in ...

Reaction to RBI's Monetary policy

Sheela Mamidenna The Reserve Bank has recently reduced the policy rates by 25 basis points to 6.25%. And this is the second time in the current financial year that the rate cut delivery has been announced. The industry has come out with its reaction to the recent change. Writing to the Dollar Business Bureau, Anuj Puri, Chairman & Country Head, JLL India gives his reaction to the recent reduction in policy rates. “Although after one round of rate cut in April, the current one has been delivered after no change in the June and August policies. This shows that the central bank remains cautious in its monetary policies and is carefully monitoring the overall economic scenario before taking steps. The first question that arises ...

RBI will keep low inflation in mind while deciding rates: FM

PTI Finance Minister Arun Jaitley on Saturday expressed hope that the Reserve Bank will keep in mind the decline in retail inflation while deciding on interest rates at its policy review meeting on October 4. "I expect when the policy review takes place next month then RBI, and hopefully if MPC is constituted by then, they will collectively keep all these factors in mind," he said when asked if declining inflation leaves room for rate cut. RBI is a responsible organisation, Jaitley said, adding, "We should wait for its judgement and we should trust its judegment". In its monetary policy review last month, RBI maintained status quo on key rates citing upside risks to 5% inflation target for March 2017. Retail inflation eased to a ...