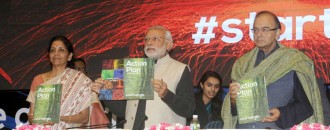

Government introduces minor changes to start-up definition

The Dollar Business Bureau The Government has introduced some slight changes to the definition of start-up and said that an entity not older than 7 years will now be eligible to get benefits under the ‘Start-up India’ Action Plan. Currently, only businesses incorporated five years back were eligible for sops under the Action Plan, which was announced by the government in 2016. According to the new definition, an enterprise with a turnover of less than Rs.25 crore shall be considered a startup if it has not finished 7 years from its date of registration/incorporation. However, for the start-ups in biotechnology sector, this period shall be 10 years, a notification by the Ministry of Commerce and Industry said. “An entity shall be considered as a startup if ...

Jewellers over Rs.12 crore turnover liable for 1% excise: FinMin

Source: PTI Finance Ministry said provisions have been made for easy compliance through use of online application for registration, payment of excise duty and filing of returns, with zero interface with the departmental officers. "An artisan or goldsmith who only manufactures jewellery on job-work basis is not required to register with the Central Excise, pay duty and file returns, as all these obligations will be on the principal manufacturers," the statement said. For determination of eligibility for small scale industries exemption for the month of March or fiscal 2016-17, a certificate from a Chartered Accountant, based on the books of accounts for 2014-15 and 2015-16 respectively, would suffice. Also, facility of Optional Centralised Registration has also been provided. "Thus, there is ...