Tata to finalise bidders for its UK business

The Dollar Business Bureau

Tata Steel stated that it has not yet shortlisted any bidder—it has received seven bidders who have shown interest in taking over its loss-making UK business. The company also specified that it has not fixed any time period, as to when it expects to sell the assets.

There was high expectation that the Tata board would formally announce a sale agreement of its bleeding business operations in the UK; specifically, after Sajid Javid, Secretary of State for Business, UK, came to the city on Wednesday, which was his second visit this month, and held discussions with Cyrus Mistry, Chairman of Tata Group.

Koushik Chatterjee, CFO, Tata Steel Group, said that the timeline for bidding was the day before yesterday (Wednesday), but they are yet to evaluate the offers and bids that the company has received, and nothing can be revealed during the process.

Chatterjee said, "We allowed all the bidders to visit the facilities, provided them with the access to our data centres, and made them meet the management, before submitting the bids." The bidders who have shown interest in the company are Greybull Capital, Newcore Steel, Liberty House, Excalibur Steel, Hebei Iron and Steel, and JSW Steel.

About 11,000 jobs at Port Talbot and 11 other company sites in the UK are hanging in the balance. Also, the British government is trying hard to ensure that there would be no job losses due to the process, which comes amidst the global slowdown in the sector caused by weak prices.

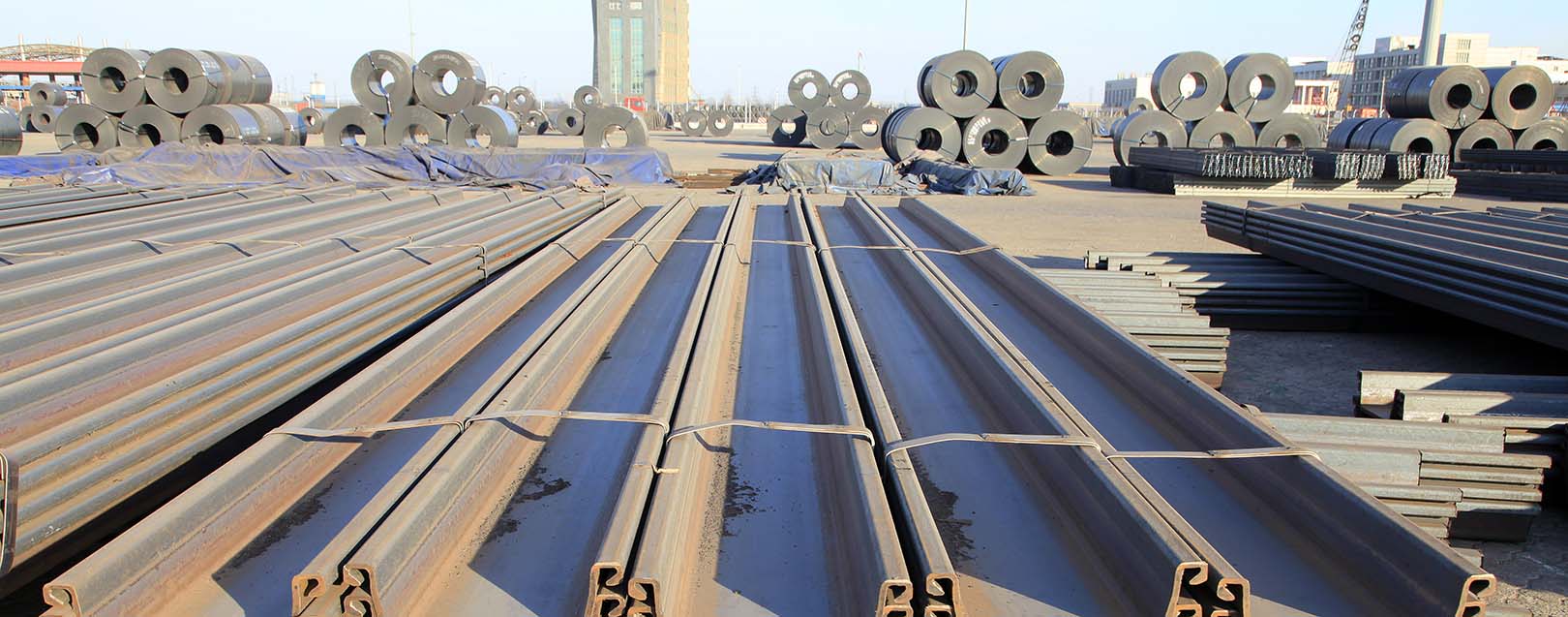

In March this year, Tata had announced its intentions to sell its loss-making businesses in the UK in the wake of the global slump in steel prices due to the oversupply of exports from China and high cost of energy.

Tata Group had acquired Corus Steel in April 2007 for over $12 billion, but since then, it has not been able to make it profitable.

to success.

to success.