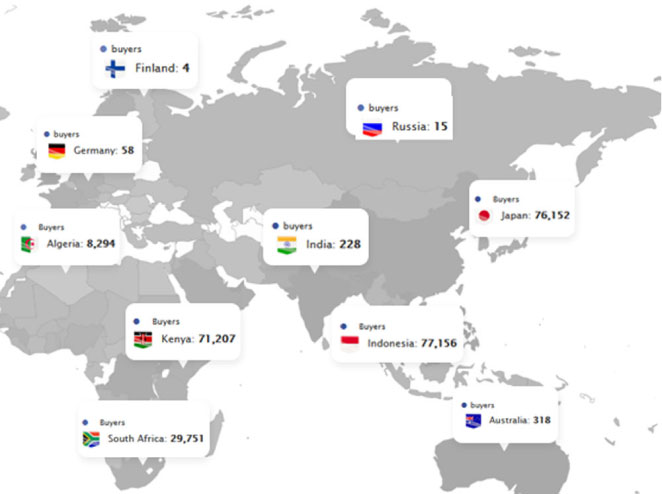

By offering outstanding analytical data on buyers and sellers worldwide with the goal of promoting global trade and building business relationships, it supports your foreign trade strategies. Through our platform, we provide you with access to 20 million active companies from 181 countries, streamlining international trade for global businesses in a world where information is crucial.

Join us to overcome challenges and unlock global opportunities.

Businesses thrive when human intelligence and business work together. As a result, the company gains strength and influence in the realm of international trade and business. Our goal is to use technological improvement to make your business futuristic so that The Dollar Business (Ex-Im) can operate globally.

You and the entire globe will benefit from this breakthrough, which offers a single platform for finding opportunities in a market with eight billion consumers. You may stay ahead of the curve and jump across continents with The Dollar Business (Ex-Im). (And acquire the upper hand to keep a lead).

Login

Making technology, information, and actionable intelligence work better for your EXIM business:

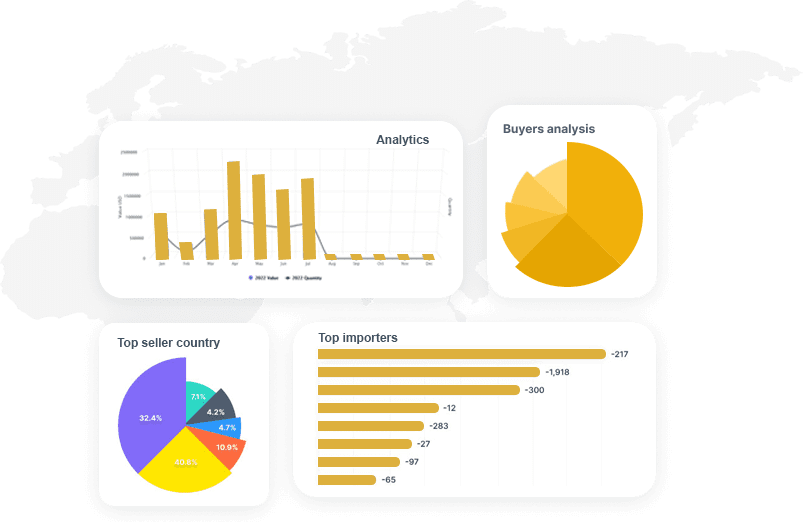

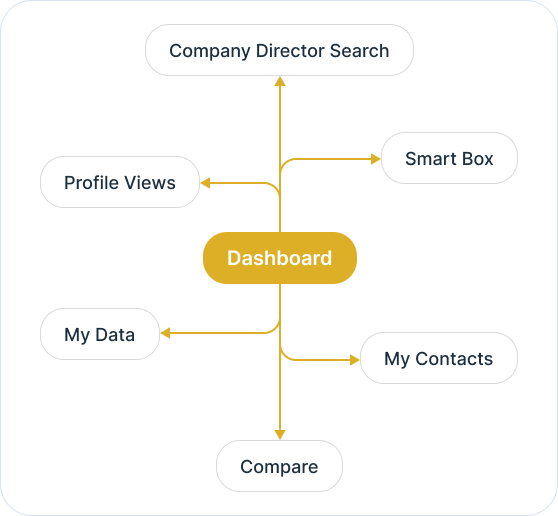

It's an intelligent dashboard designed for our ever expanding network of the most astute customers on the planet.

It provides a deeper understanding of supply networks and export-import markets and aids in increasing their adaptability.

It provides deeper understanding of supply networks and export-import markets and aids in increasing their adaptability.

We make sure that our users receive “only useful” content. We support them in making strategic choices.

The Ex-Im intelligent dashboard understands your needs.

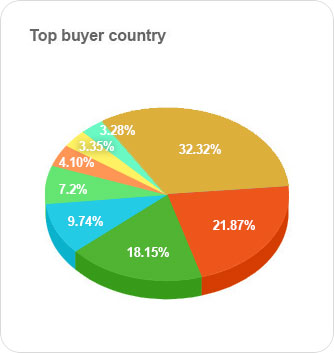

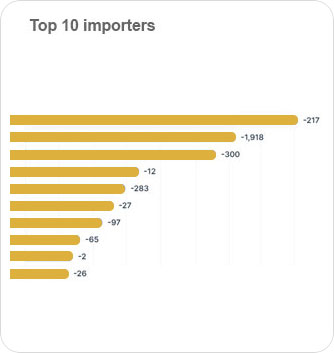

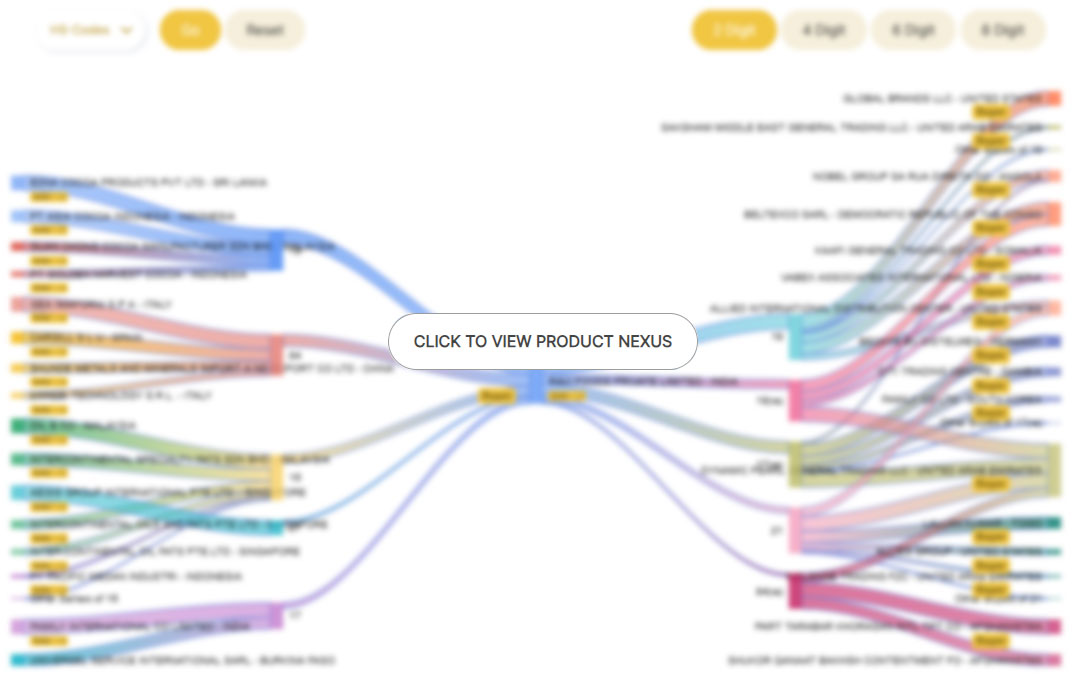

To whom does your rival sell? Who is his most avid customer? Who is the potential buyer for you? Similar-natured and weighted business questions have an answer in Nexus. Not to mention, our users now have a true sustainable competitive edge because they can better assess the transactions of their rivals and adjust their strategies as a result of having access to such valuable information.

The relationship between different buyer-seller firms in relation to "specific product categories" are broken down by product nexus. Which suppliers does the business use for its raw materials, and what are they? To whom and what products is it selling? A company's relationships with buyers and sellers that are specific to its products are displayed in the Product Nexus. That certainly sounds like a product designed for the astute and modern exporter-importer.

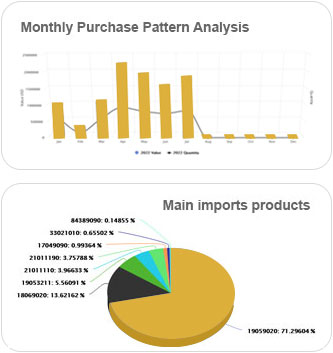

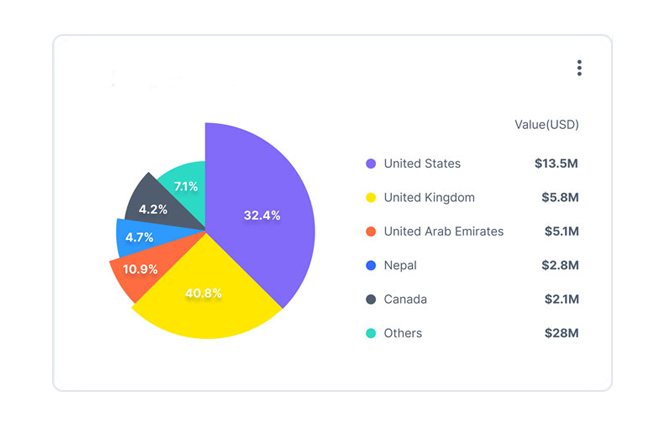

Our trade analytics suite helps our

users make informed decisions

The way the complete shipping process is handled can often make or break a foreign trade deal. The procedure entails determining the answers to queries like:

While theoretically, you could go about with the research and calculation, practical experience appears to be the right place to look for answers.